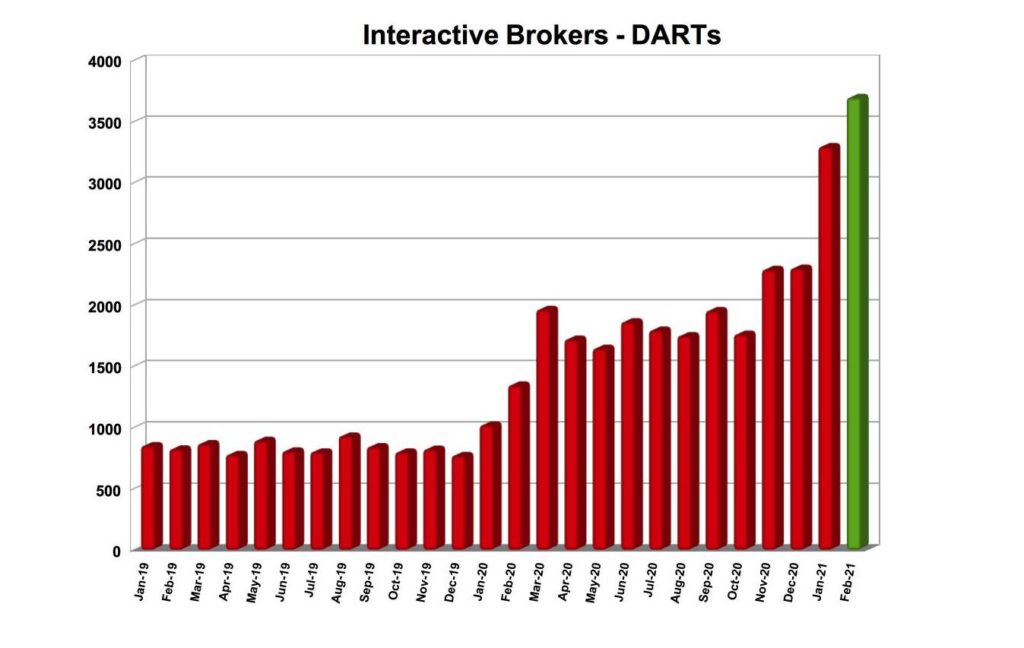

Interactive Brokers reports further increase in trading activity in Feb 2021

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just reported its key operating metrics for February 2021.

After a very solid first month of the year, the brokerage continued to enjoy a rise in trading activity, as indicated by the growth in daily average revenue trades (DARTs).

Interactive Brokers reported 3,695,000 DARTs for February 2021, 175% higher than in February 2020 and 12% higher than in January 2021.

Ending client equity amounted to $329.9 billion in February 2021, 94% higher than prior year and 5% higher than prior month. Ending client margin loan balances totalled $42.1 billion, 46% higher than prior year and 3% higher than prior month.

Ending client credit balances amounted to $85.0 billion, including $2.8 billion in insured bank deposit sweeps2, 43% higher than prior year and 3% higher than prior month.

The number of client accounts kept increasing, reaching 1,265,000 in February 2021. The result is 76% higher than prior year and 6% higher than prior month.

The average commission per cleared Commissionable Order was $2.30 including exchange, clearing and regulatory fees.

Let’s recall that, for the fourth quarter of 2020, Interactive Brokers reported net revenues of $599 million and income before income taxes of $392 million, compared to net revenues of $500 million and income before income taxes of $312 million for the equivalent period in 2019.

Adjusted net revenues were $582 million and adjusted income before income taxes was $375 million for the final quarter of 2020, compared to adjusted net revenues of $503 million and adjusted income before income taxes of $315 million for the same period in 2019.

Net interest income decreased $62 million, or 22%, from the year-ago quarter as the average Federal Funds effective rate decreased to 0.09% from 1.65% in the year-ago quarter.