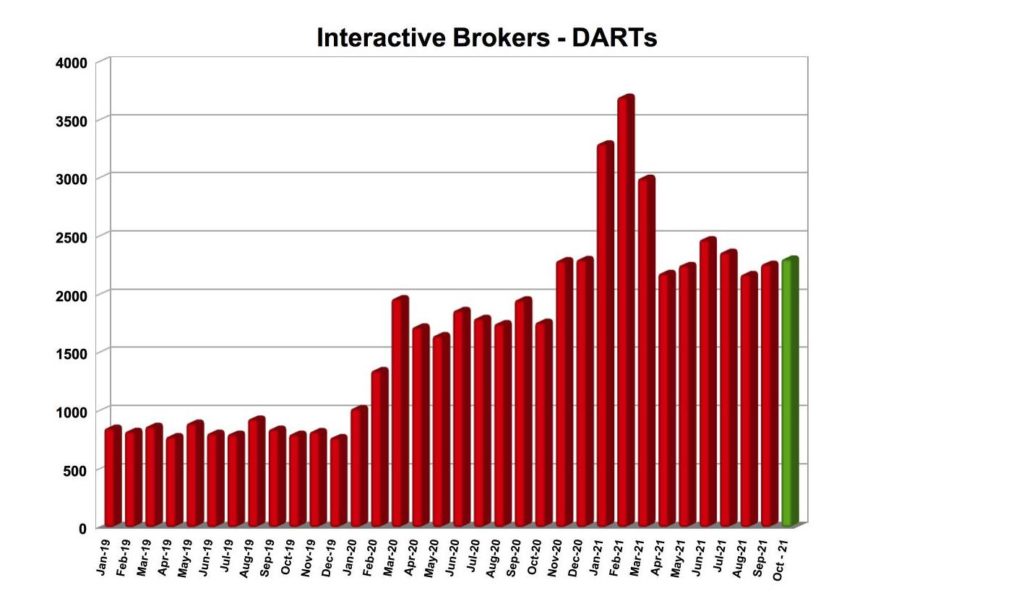

Interactive Brokers registers steep rise in DARTs in Oct 2021

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just posted its key performance metrics for October 2021.

The broker reported 2.305 million Daily Average Revenue Trades (DARTs) for October 2021, 31% higher than prior year and 2% higher than prior month. Let’s recall that in September the broker also saw a rise in trading volumes.

Ending client equity amounted to $380.9 billion, 64% higher than prior year and 8% higher than prior month, whereas ending client margin loan balances were $53.7 billion, 69% higher than prior year and 7% higher than prior month.

Interactive Brokers registered 1.58 million client accounts, 57% higher than prior year and 3% higher than prior month.

Average commission per cleared Commissionable Order was $2.48 including exchange, clearing and regulatory fees.

Speaking of Interactive Brokers’ performance, let’s recall that the broker reported diluted earnings per share of $0.43 for the third quarter of 2021 compared to $0.58 for the equivalent period in 2020, and adjusted diluted earnings per share of $0.78 for this quarter compared to $0.53 for the year-ago quarter.

Net revenues were $464 million in the third quarter of 2021, down from $548 million a year earlier.

Income before income taxes was $234 million for the third quarter of 2021, compared to $334 million for the same period in 2020.

Commission revenue increased $32 million, or 11%, from the year-ago quarter on the back of higher customer stock and options trading volumes.

Net interest income increased $79 million, or 41%, from the year-ago quarter thanks to higher margin loan balances and strong securities lending activity.