IG Group activity moderates after record revenues and profits for 2H-2020

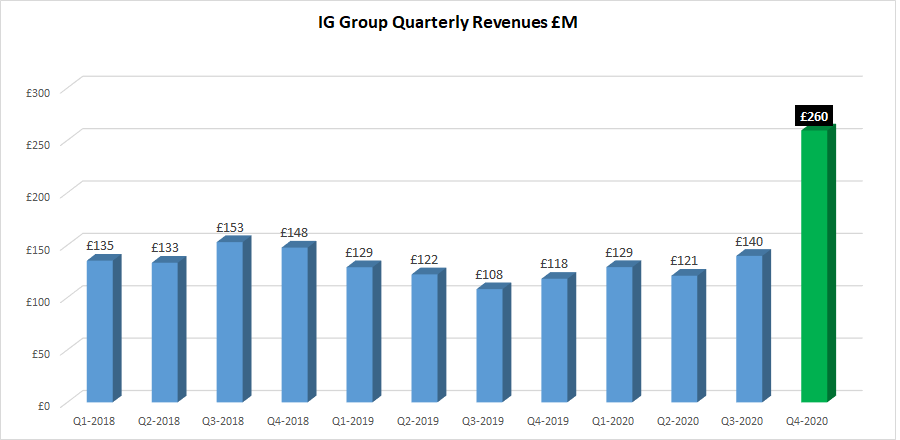

Sometimes a picture, or graph in this case, tells most if not all of the story. And we believe that to be true in this instance – that is, how the Covid-19 pandemic and surrounding financial market volatility has benefited top retail FX and CFD brokers.

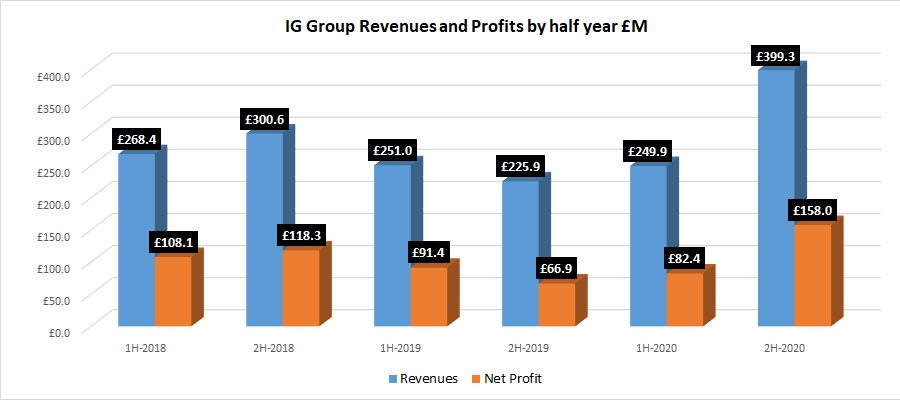

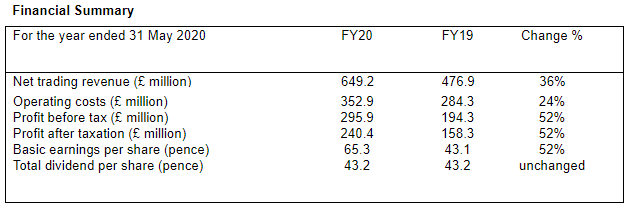

IG Group reported today its full FY 2020 results (IG has a May 31 fiscal year end), revealing record revenues and profits in the second half of the year (December 2019 through May 2020), and particularly in the March-April-May 2020 quarter following the outbreak of the global Covid-19 crisis.

IG had already disclosed that Q4 saw absolutely blowout record Revenues for the company, at £259.5 million, and actually revised those slightly upward in today’s release. That is over £100 million more in Revenue than IG’s best ever previous quarter.

Today, not surprisingly, IG revealed that the Revenue bump led to record profits for the company – £158 million in the second half of the year and £240 million for the full FY 2020 year.

Beyond the financial figures, IG had a good year on other fronts. Active clients grew 34% to 239,600, with 96,900 new clients onboarded in FY20. Early in FY21 IG began a rebranding of the company, as was exclusively reported at FNG.

But as far as outlook goes, IG said that it anticipates a reversion to more “normalised levels” of market volatility during the course of FY21. Although current trading into early FY21 has continued to reflect elevated levels of volatility, IG said that this has moderated since the peak seen in March.

IG said it anticipates maintaining momentum around the Core Markets and the portfolio of Significant Opportunities, continuing the progress made in FY20, to deliver its medium-term financial targets. These targets remain unchanged; revenue growth in Core Markets of 3-5% over the medium term, and an incremental £100 million of revenue by the end of FY22 relating to the Significant Opportunities portfolio.

On the expense side, in FY21 IG expects to grow underlying operating expenses by 3%. Additionally, in order to support the planned next stage of development in the Significant Opportunities portfolio and to further increase scalability and resilience in its technology and operations, the group plans to make a £10 million investment in the year. Variable remuneration in FY21 is anticipated to be around the midpoint of the FY19 and FY20 levels.

June Felix, IG Group Chief Executive, commented:

“It’s been a successful first year in our three-year growth strategy to become a more sustainable, diversified, and global business. We concluded FY20 well on track to deliver on our medium-term targets and are confident in achieving the goals we’ve set. I’m delighted with the tangible progress we’ve made, the resilience we’ve shown as a company, and the record results we’ve delivered.

Our focus is on providing a first-class service to sophisticated clients wanting to trade our products across a range of global financial markets. IG’s continued investment in people and technology will further improve our platform and continue to deliver the new functionality and capabilities that our clients expect. Our clients are one of our most important stakeholders and our interests are aligned with theirs. Our success is built on their long-standing support and loyalty. In FY20, we experienced growing client demand across the world for IG’s products and services even prior to the exceptional period in Q4, and delivered record results.

I am particularly proud of how our people have worked together through the Covid-19 pandemic to support our clients, their colleagues, and the broader communities in which we operate. Their performance during this extraordinary time has demonstrated that they are a credit to the business, and a key asset. We are aware that this is a difficult time for many, and this is why we have chosen to make a £5 million donation to the IG Brighter Future Fund, for children whose educational opportunities have been most impacted by Covid-19.

This year we have also welcomed Mike McTighe, Chairman of the Board, and Charlie Rozes, our new CFO, to IG Group. They both bring extensive international experience to the Company. I am looking forward to working closely with them as we continue to focus on delivering sustainable growth and attractive shareholder returns.”

IG Group’s full press release on its FY 2020 results can be seen here.