Exclusive: Spreadex revenues and profits hit in 2020 from Covid-19

FNG Exclusive… FNG has learned via regulatory filings that UK financial and sports spreadbetting outfit Spreadex took a hit in its Fiscal 2020 year (ended May 31), due to the Covid-19 crisis.

Covid-19 killed virtually all UK (and global) sporting events in the company’s fiscal fourth quarter, leading to a near-zero Revenue stream from sports betting for a near-three month period.

The decline in sports activity, however, was at least somewhat offset by increased financial spreadbetting, with Spreadex benefiting from increased client financial trading activity as markets became increasingly volatile over a protracted period.

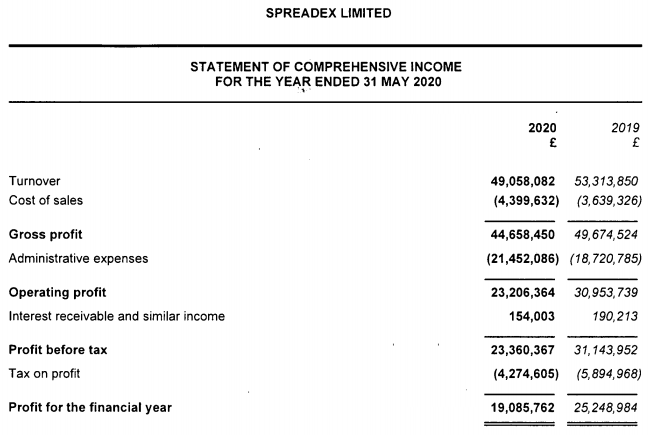

Overall, Revenues for 2020 came in at £49.1 million at Spreadex, down 8% from £53.3 million in 2019. Net profit of £19.1 million was off 24% from £25.2 million last year. Spreadex didn’t break out the exact division between its sports and financials divisions.

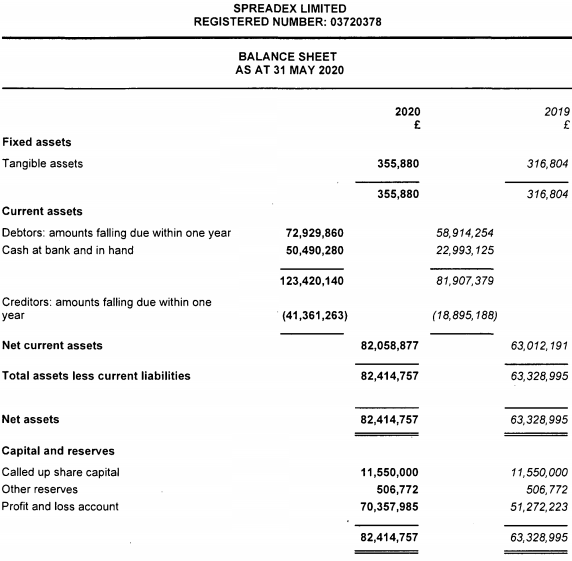

Spreadex said that no dividend was paid or declared during the year in order to retain cash in the business to strengthen the balance sheet through these turbulent times.

Spreadbetting is a modified version of CFD trading commonly used mainly in the UK. With Spreadbetting, the trader is making a bet based on the direction and size of a financial instrument’s movement. Spreadbetting allows the user to bet a certain amount per “point” of spread movement of a financial instrument. For example, if the last trade of an instrument (e.g. a forex pair, stock, commodity, index…) was 100, and the “spread” being offered by the broker was 99-101, the trader could decide to bet a fixed amount (say £10) per “point” of spread. If the instrument moved to 110 (and the bet was that the instrument would indeed move up) with the spread similarly moving to 109-111, then the profit on the trade would be £80: £10 * (109-101).

Spreadex’s largest shareholders are Bourne Leisure founder Peter Harris, and Spreadex founder Jonathan Hufford.

Spreadex’s 2020 income statement and balance sheet follow: