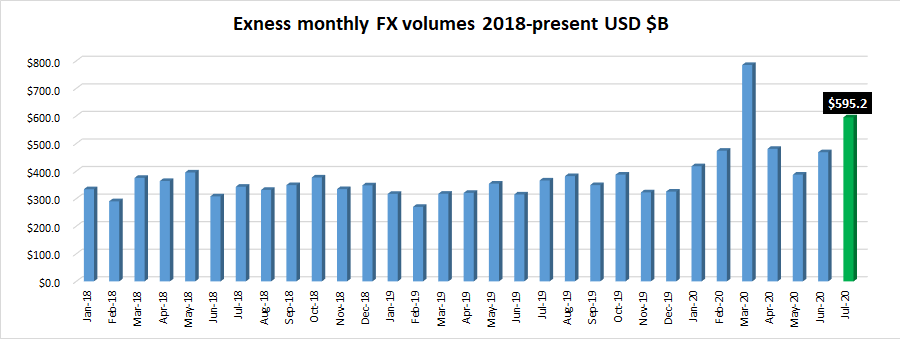

Exness has strong July, trading volumes top $595 billion

Forget about summer slowdown!

In a year which has been anything but typical in the Retail FX trading world (or, anywhere else for that matter), the usual slowdown in trading activity during the summer months has failed to materialize, at least so far at Exness.

The global forex broker has posted its July trading metrics indicating that the normally slow first full month of summer month was anything but. Total client trading volumes came in at $595.2 billion at Exness during July, up 27% over what was a fairly decent June.

In fact, July was Exness’ second best month ever, topped only by March’s $785 billion, representing only the second time Exness monthly volumes have passed the $500 billion mark.

We understand that July volumes were driven by a surge gold CFD trading, as gold prices continued a steady climb during the month to all time record levels. FNG spoke with Exness Chief Commercial Officer David Moyes, who had the following to say:

“The current market volatility, more specifically with Gold, has definitely contributed to our increase in volumes to over $595 billion in July. This externality combined with our consistently increasing number of monthly active traders, which now stands at over 135,000 traders for the month of July, has driven trading volumes up to the second highest monthly record since the company was founded in 2008, with the highest being in March 2020, up 63% from the same time last year. We attribute this growth largely to our ability in providing our customers with the best trading experience possible in these challenging market conditions.”

Exness also saw a record number of active clients during July at 135,424, up 5% from June’s 128,619.

Exness has its client volumes, client withdrawal figures and agent commissions paid audited each quarter by Deloitte.