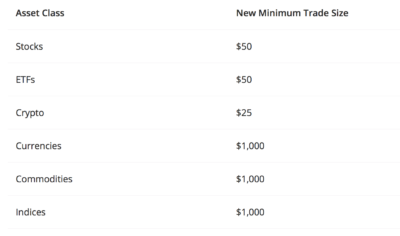

eToro introduces lower, unified minimum trade sizes

Social trading focused retail FX and CFD broker eToro is enhancing the trading conditions for its clients. The company is introducing new, lower minimum trade sizes.

In each new jurisdiction where eToro expanded, it had to adjust and tweak its offerings to match local regulations, audiences and available instruments. Therefore, minimum trade sizes varied in different locations and for different asset classes. In addition, the distinction between CFD positions and ownership of underlying assets also had an effect on minimum trade size. But that is no longer the case.

The broker said it realised that the minimum trade size may serve as an entry barrier for some users who wish to diversify their portfolios, or to explore new markets. Therefore, e Toro has lowered the minimum trade size and made sure that it will be exactly the same everywhere around the world.

One important thing to consider is that the minimum trade size takes leverage into account. For example: The minimum trade size for oil (commodity) is $1,000, but this does not mean that traders need to allocate $1,000 of their funds to open a position. Using leverage of 10x, traders can invest as little as $100 and open a position on oil. eToro notes that leverage carries a higher degree of risk, as both losses and gains are multiplied by the leverage factor.