CMC Markets registers 32% Y/Y drop in trading revenue in H1 FY24

CMC Markets Plc (LON:CMCX), a global provider of online retail and institutional platform technology, today reported its interim results for the half year ended 30 September 2023.

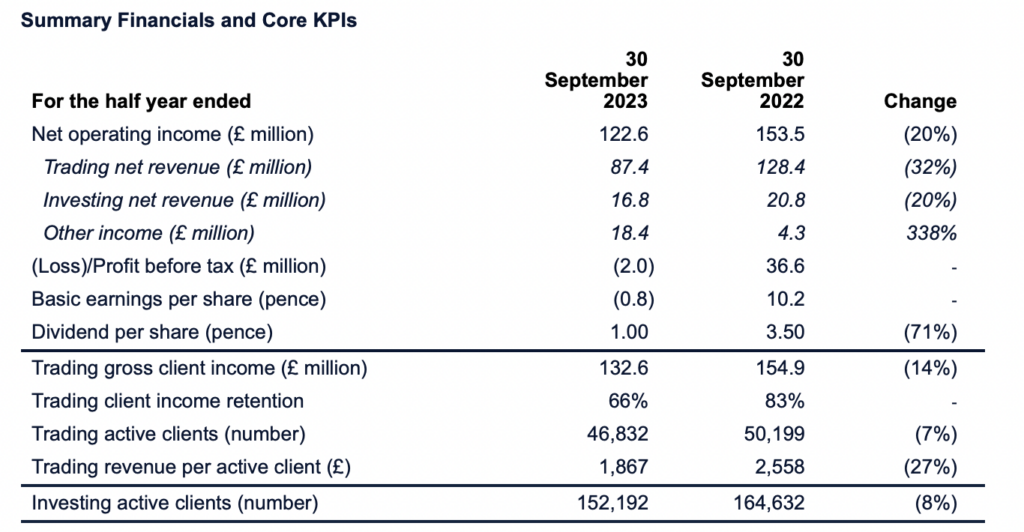

The first six months of the year were categorised by a reduction in market volatility and client trading volumes resulting in a decline in net operating income versus the same period last year. H1 2024 trading net revenue was £87.4 million (H1 2023: £128.4 million), down 32% year-on-year. H1 2024 investing net revenue was £16.8 million (H1 2023: £20.8 million), down 20% year-on-year, due to lower activity and unfavourable market conditions resulting from the uncertainty around the global economic outlook, inflationary pressures and the resultant impact on interest rates.

Client trading assets under management finished the period at £501 million, marginally below the HY 2023 number of £506 million. H1 2024 active trading clients were lower compared to H1 2023 (down 7% to 46,832), with an associated decrease in revenue per client.

Invest Australia net operating income decreased 2% (£0.5m) year-on-year primarily driven by unfavourable movements in the GBP/AUD exchange rate, partially offset by a 7% (£1.5m) growth in underlying local currency performance. CMC has increased its market share against its direct competitors, up 0.4% year-on-year to 16.4%. Assets under administration (“AuA”) of A$71.5bn were also up 1% (A$0.8bn) year-on-year.

On 31 July 2023, new rules came into effect for financial services firms on Consumer Duty in the UK. These new rules aim to set a high standard of consumer protection when dealing with financial services. The implementation of the Duty within the Group has been successful and CMC continues to enhance its post-implementation processes and measure client outcomes to ensure that clients continue to achieve their financial objectives.

The Board has declared an interim dividend of 1.00 pence per share for the period (H1 2023: 3.50 pence per share). This is in line with the dividend policy of 50% of profit after tax, whilst the Group made a loss in H1 2023, the interim dividend is being declared in line with full year earnings expectations.

Full year net operating income is expected to be between £250-£280 million with operating costs at £240 million excluding variable remuneration. CMC expects to deliver net operating income in FY 2025 in line with current market consensus, based on more normalised trading conditions.

Lord Cruddas, Chief Executive Officer, commented:

“I am pleased with the resilience the business has demonstrated in the first six months of the year in what has been a tough market environment, with low volatility offering fewer opportunities for clients of our trading business. Despite the subdued market conditions, we have seen continued commitment from our existing clients and positive engagement in our institutional business.

Our diversification strategy continues to progress and is on track with major releases in the period and several others planned for the coming months. This was punctuated by the successful launch of CMC Invest Singapore in September 2023, which is attracting new clients to the business and expanding our footprint in the southeast Asia region. In the UK, our Invest platform continues to demonstrate good progress with the recent release of mutual funds and SIPP accounts soon to follow, helping our clients achieve their long-term financial goals.

We continue to widen our trading offering which will be bolstered by the upcoming rollout of our options products, whilst the addition of cash equities to our institutional offering will allow us to expand the services available to this valuable segment and help us attract new business. Our geographical diversification has also continued with the recent expansion of our Dubai subsidiary in the DIFC providing us a strong foothold in one of the most exciting financial centres in the world.

The power of our technology platform has been central to our ability to expand our offering and provide new products and capabilities for our clients. As these new products come online, we are well positioned to increase synergies across our suite of businesses and drive operational efficiencies. Our technology remains our competitive advantage and we are committed to a disciplined level of continuous investment, however with all that has been achieved over recent years the level of capital investment has now peaked.

I am very excited about the future of the company and the opportunities that our diversification strategy has opened up for us in many parts of the world.”