City Index to change margin requirements around US election

UK online broker City Index plans to change margin requirements for a number of trading instruments around the US election.

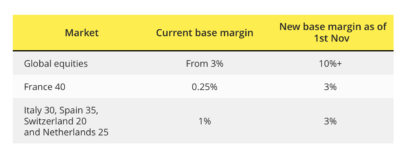

As a result of heightened market volatility surrounding the US Election, the broker says it has temporarily increased margin requirements or Global Equities, France 40, Italy 30, Spain 35, Switzerland 20 and Netherlands 25.

- The base margin for Global Equities will be increased from 3% to 10%.

- The base margin for France 40 will rise from 0.25% to 3%.

- The margin for Italy 30, Spain 35, Switzerland 20 and Netherlands 25 will increase from 1% to 3%.

The changes mean traders will need increased margin to maintain existing positions and open new positions. The broker advises its clients to ensure they keep their account well funded over the coming days.

City Index offers shares trading as spread betting and CFD trading on over 4500 global shares. Spreads start from 0.1% each side.

The broker offers traders to make use of customisable charts. The list includes 16 chart types with more than 80 indicators designed to help traders perform technical analysis. In addition, City Index’s research portal highlights trade ideas using fundamental and technical analysis.

Established in the UK in 1983, City Index is one of the major providers of Spread Betting, FX and CFD Trading. With over 12,000 markets to choose from across Forex, Indices, Shares and Commodities, City Index’s clients have access to a wide range of global markets.

City Index’s parent company is StoneX Group Inc (NASDAQ: SNEX), one of the largest retail and institutional trading providers in the world and has a strong track-record in providing retail and institutional customers with trading services. StoneX has recently completed its acquisition of GAIN Capital.