Citadel, IBKR, Robinhood, Apex nix conspiracy claims in short squeeze lawsuit

The defendants in the antitrust tranche of a short squeeze litigation have managed to secure an important win, as the Florida Southern District Court has nixed the conspiracy claims against E*Trade Securities LLC; E*Trade Financial Holdings, LLC; Interactive Brokers LLC; Robinhood Markets, Inc.; Robinhood Financial LLC; Robinhood Securities, LLC; Citadel Securities LLC; Apex Clearing Corp.; Electronic Transaction Clearing, Inc.; and PEAK6 Investments LLC.

The relevant order, seen by FX News Group, was signed by Chief Judge Cecilia M. Altonaga on November 17, 2021.

This putative class action is brought on behalf of individual investors who suffered losses as a result of the defendants’ response to a “short squeeze” — a situation in which stocks or other assets rise sharply in value, distressing short positions. This short squeeze occurred in late January 2021, as the retail investors rapidly purchased certain stocks they believed would increase in price: GameStop (GME), AMC Entertainment (AMC), Bed Bath & Beyond (BBBY), BlackBerry (BB), Express (EXPR), Koss (KOSS), Nokia (NOK), Tootsie Roll Industries (TR), and Trivago NV (TRVG), exposing those with short positions to “massive potential losses.

According to the plaintiffs, the defendants conspired to prevent these losses by “artificially constricting the price appreciation of the relevant securities,” in violation of the Sherman Act, 15 U.S.C. § 1.

The defendants have moved to dismiss the antitrust complaint. On November 17, 2021, the Court sided with the defendants.

The Judge explains that the plaintiffs fail to plead a conspiracy.

Plaintiffs contend they have plausibly alleged facts, both direct and circumstantial, that “Citadel Securities conspired with the Brokerage Defendants and the Clearing Defendants to prevent retail investors from purchasing shares of the Relevant Securities to artificially suppress share prices so that Citadel Securities could cover its short positions and mitigate its potential losses”. The Court examined these allegations that purport to support the existence of a conspiracy directly or circumstantially.

To begin, Plaintiffs allege that “high-level executives of Citadel Securities regularly communicated with and coordinated with high-level executives of Robinhood and others in the lead up to, during and after the restrictions imposed on or around January 28, 2021.” Yet, by Plaintiffs’ own admission, “the written communications appear deliberately vague and do not describe the contents of what was agreed to in the communications.”

The Court finds that the alleged communications between Citadel Securities and Robinhood merely show that high-level executives at both firms agreed to “chat” and “work together.” The complaint does not detail any subsequent discussions because “these communications have not been disclosed.” These unknown discussions have no relevance at all unless one infers that Citadel Securities requested that Robinhood restrict trading in the Relevant Securities and Robinhood agreed.

Similarly, Plaintiffs claim that “on January 28, 2021, high level employees of E*Trade communicated with employees of Citadel Securities to ensure certain orders were cancelled.” As support, the complaint contains a screenshot of a January 28, 2021 email between the Senior Manager for Trading Operations for E*Trade and a Citadel Securities employee titled, “RE: Potential open orders.” The E*Trade executive lists a number of securities and asks: “can you confirm you’re out on these?” The Citadel Securities employee responds, “canceled”.

As described by the defendants, this appears to be “no more than a routine daily trading account reconciliation email canceling ten trade orders, and Plaintiffs fail to allege that the email even pertains to the Relevant Securities.”

The Judge states:

“To conclude this email evidences an unlawful agreement to restrain trade requires an exercise in incredible leaping logic in which the Court declines to engage”.

According to the Court, taken together, the plaintiffs fall far short of providing allegations “explicitly manifesting the existence of the agreement in question”.

The order says that the plaintiffs ask the Court to infer the Brokerage Defendants and Clearing Defendants had a common motive to illegally restrain trade simply because Citadel Securities is an important business partner of the other Defendants and might have suffered losses as a result of its short positions in the Relevant Securities. Yet, the plaintiffs also maintain that “restricting trading in the Relevant Securities is against the Brokerage and Clearing Defendants’ self-interest” because they earn revenue from each transaction and because the trading restrictions create a risk of “both immediate and long-term reputational harm.”

As the defendants note, there are no allegations that Citadel Securities threatened or suggested it would cut off business relationships with any other defendants if they did not impose trading restrictions, and the plaintiffs fail to otherwise explain why each Defendant would not simply use another market maker in such a scenario.

The Court states that “the mere fact that Citadel Securities is an important business partner of the other Defendants does not provide sufficient motive to conspire”.

Robinhood and multiple other Defendants cited the extraordinary market volatility and/or collateral requirements as the motivation for their trading restrictions. According to the Court, the fact that each Defendant implemented varying trading restrictions gives support to their stated reasons because each Defendant would have its own unique risk tolerance and collateral requirements.

And considering the complaint itself states that firms not alleged to be part of the conspiracy also restricted transactions in the Relevant Securities and similarly cited “unprecedented market conditions,” the Court finds Plaintiffs’ theory regarding motive implausible.

To recap, Plaintiffs adequately explain Citadel Securities’ motive for allegedly orchestrating the trading restrictions imposed by the Brokerage Defendants and Clearing Defendants. But the Court is unconvinced that Plaintiffs have set forth a coherent common motive as to the Brokerage Defendants and Clearing Defendants.

The complaint alleges several interfirm communications.

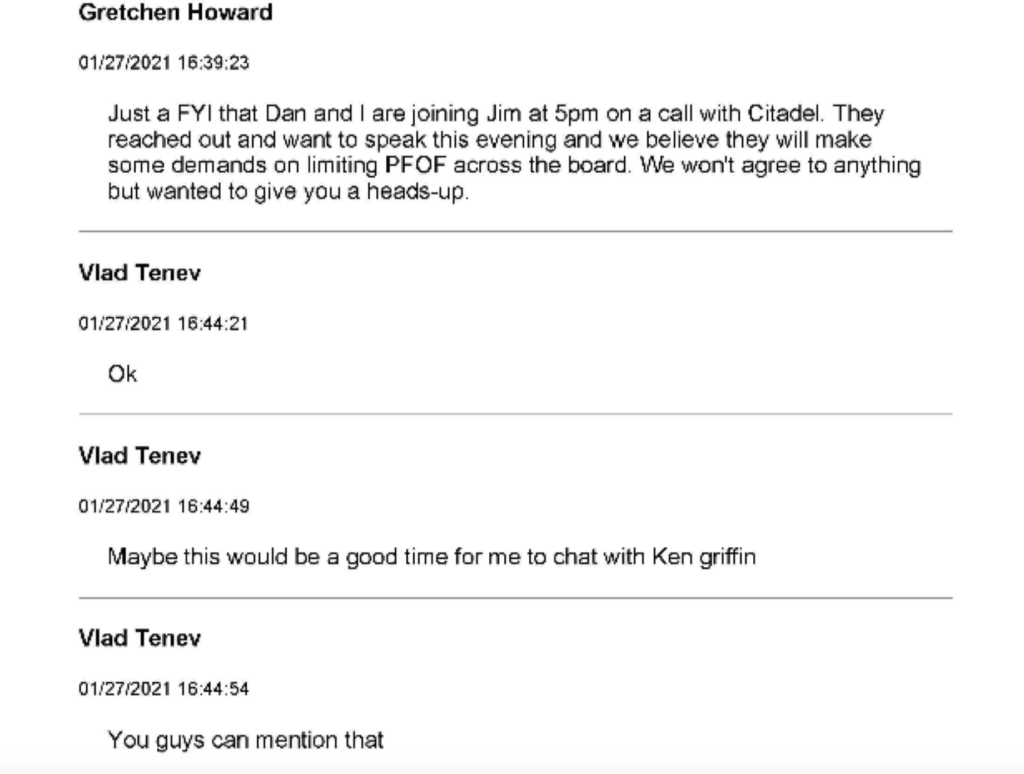

Around 4:40 p.m. EST on January 27, 2021, Gretchen Howard, Robinhood’s COO, messaged Vlad Tenev, Robinhood’s CEO, that she, along with Daniel Gallagher and Jim Swartwout, Robinhood’s Chief Legal Officer and Robinhood Securities’ President and CEO, would be joining “a call with Citadel” at 5 p.m. that day. Howard told Tenev that she believed Citadel Securities would “make some demands on limiting [payment for order flow] across the board” but that they “won’t agree to anything[.]”

Tenev told Howard that although he had never met Ken Griffin, the CEO of Citadel Securities, she could mention on the call that “this would be a good time for [Tenev] to chat with [] Griffin[.]”

The request from a market maker to limit the order flow sent to it is not equivalent to a demand to restrict trading in certain securities; however, the timing and the involvement of high-level executives render these emails relevant.

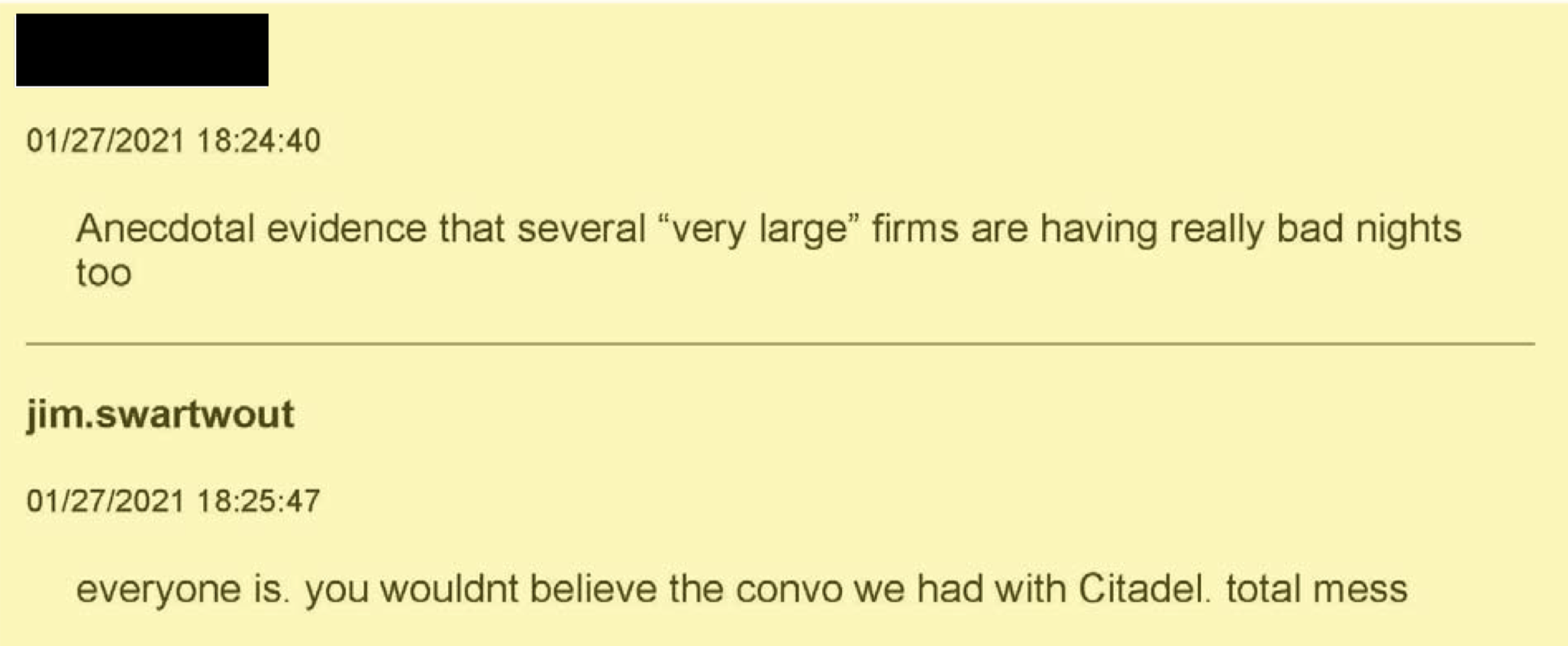

Roughly two hours later, Swartwout received an internal message stating there was “anecdotal evidence that several ‘very large’ firms are having really bad nights too”; to which Swartwout replied, “everyone is. You wouldnt [sic] believe the conversation we had with Citadel. Total mess.”

Around 8:30 p.m. that night, Swartwout emailed Citadel Securities’ Vice President of Business Development to offer to set up a call that night with Tenev, and mentioned Tenev would like to have a discussion with Griffin at some point, given their relationship, but “not specific to this crazy issue.” After the Citadel Securities executive asked Swartwout if Tenev would like to have the call that night, Swartout declined and said: “just looking for your dictated schedule and caps. I have 20 minutes until batch so whatever it is we are not going to be able to address it tomorrow given the notice. I have to say I am beyond disappointed in how this went down. It’s difficult to have a partnership when these kind[s] of things go down this way.”

Again, the Court finds these emails are vague and ambiguous, and are only relevant considering the timing and those involved.

Given the timing, the players involved, and the fact that each of these emails could be inferred to relate to the trading restrictions imposed on January 28, 2021, Plaintiffs’ allegations of interfirm communications are supportive of a conspiracy. The support is thin, however, the Court concludes.

The plaintiffs concede they do not know what was discussed during the several calls between Robinhood and Citadel Securities executives. In addition, complaint lacks specific allegations of interfirm communications between any other alleged co-conspirator. The Court thus finds no support for a reasonable inference of a conspiracy involving any other defendants.

In sum, Plaintiffs establish a plus factor here supporting, albeit weakly, an inference of a conspiracy between Robinhood and Citadel Securities.

The Judge concludes the order with the following remark:

“But are a few vague and ambiguous emails between two firms in an otherwise lawful, ongoing business relationship enough to nudge Plaintiffs’ claims across the line from conceivable to plausible? The Court thinks not”.

Although the complaint against the defendants is dismissed, the plaintiffs have until December 20, 2021 to file their final amended complaint in the Antitrust Tranche of this Multidistrict Litigation. Hence, the lawsuit continues.