FCA receives 291 new whistleblowing reports in Q3 2022

The UK Financial Conduct Authority (FCA) today published its whistleblowing data for the third quarter of 2022.

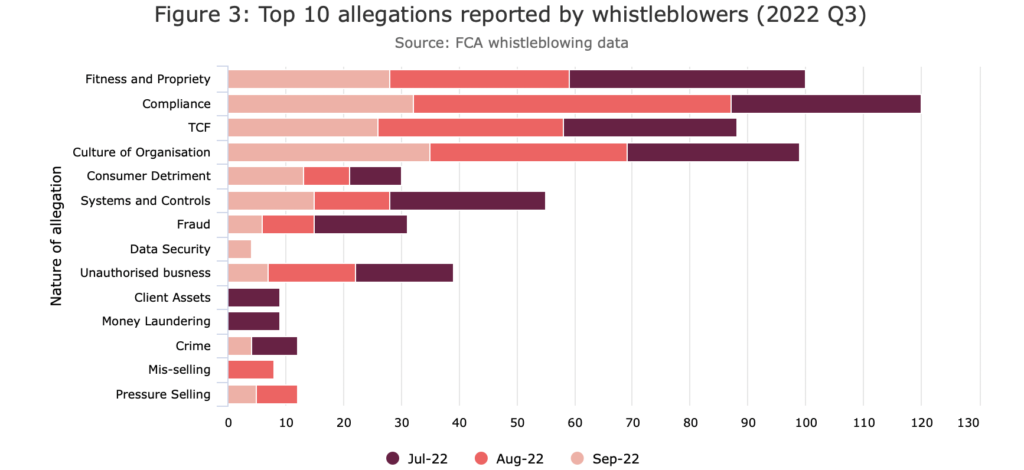

The regulator received 291 new whistleblowing reports in the July-September 2022 period. This is higher than the 243 reports received in the preceding quarter.

Typically, the reports the FCA receives will contain allegations that fall under the following five overarching themes:

- fitness and propriety

- treating customers fairly

- FSMA

- culture

- compliance

Compliance disclosures refer to any allegations where a firm, individual or system is not applying oversight or governance to an activity. This could relate to consumer advice, internal systems and or the conduct of a specific team. All firms are expected to have compliance and governance functions as part of their internal review and audit structure.

Whistleblowers are protected by the Public Interest Disclosure Act 1998 (PIDA), which means that you may obtain a remedy if you are hurt, suffer detriment or are dismissed because you have blown the whistle in the public interest. This is enforceable through an Employment Tribunal.

PIDA was introduced to encourage and give workers the legal support to speak up if they have concerns about wrongdoing in their workplace.

It makes provision about the subject matter of the disclosure, the motivation and beliefs of the worker, and the person(s) to whom the disclosure is made.

Whistleblowers can directly report wrongdoing to the FCA. The regulator has a special (‘prescribed’) role under PIDA. Under PIDA, if a whistleblower makes a report to a prescribed person, such as the FCA, they will potentially qualify for the same employment rights as if they had made a report to their employer. If they do qualify, reporting to the employer directly is not required.

Since leaving the EU, the relevant regulatory responsibilities of the European Securities and Markets Authority (ESMA) have been assigned to the FCA. This means that the FCA can accept whistleblower disclosures about possible breaches of UK Securitisation Regulation, UK Securities Financing Transactions Regulation and the UK Credit Rating Agencies Regulation.