DigitalX launches RegTech solution Drawbridge

Shortly after the securities of DigitalX Ltd (ASX:DCC), a technology company specialising in blockchain application development and digital asset management services, were placed in trading halt pending an announcement, the company did release an announcement, and it concerns a new product.

DigitalX today announced the launch of Drawbridge, its first RegTech product for publicly traded entities. Drawbridge addresses a need for improved administration of securities dealing policies by listed entities, which specify the compliance rules for those companies in managing insider trading risks and the orderly acquisition and disposal of securities in those companies by those within the company.

Over 10,000 “change in director interest” notices are lodged annually on the Australian Securities Exchange (ASX) alone, with the process often prone to high profile mistakes to the detriment of shareholders, caused in part by human error or a lack of understanding of when it is appropriate or inappropriate to trade securities in the entity, DigitalX explains.

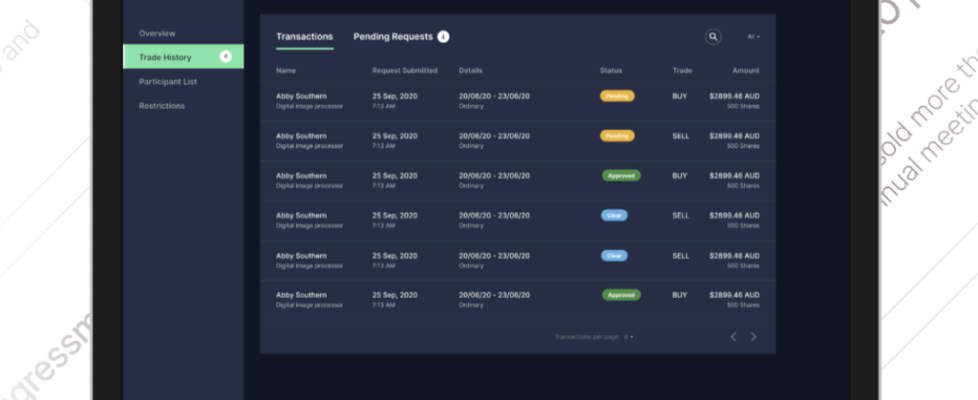

The Drawbridge application allows listed companies to digitise trading restrictions under their policy and automate necessary approvals for employee and director trading. The product’s future development will look to add additional features such as an employee share sale facility, training and education option, and real-time access to trading data for companies utilising the product.

Drawbridge is the first step in the company’s strategy to utilise its blockchain and market experience to develop scalable products within the RegTech market.

Earlier this year, the company established a research and development program to prioritise opportunities for commercialising RegTech products and blockchain technologies with strong financial markets applications, utilising the company’s experience in using and developing blockchain technologies. The program included meeting with various parties involved in the regulatory ecosystem for public companies in Australia to identify common regulatory requirements that could be considered for blockchain-based improvements, as well as considering internally how products could be designed to address those requirements.