ASIC records steep increase in civil penalty proceedings

The Australian Securities and Investments Commission (ASIC) has today issued its enforcement update report for the period 1 July to 30 December 2020.

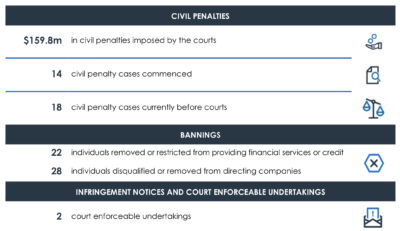

The July to December 2020 period saw civil penalties totalling $159.8 million imposed by the courts. This included ASIC’s two largest ever civil penalty outcomes – penalties totalling $57.5 million were imposed on two NAB subsidiaries for fees-for-no-service misconduct, and penalties totalling $75 million were imposed on OTC derivatives provider AGM Markets Pty Ltd and two of its authorised representatives for systemic unconscionable conduct.

Let’s recall that, on October 16, 2020, the Federal Court of Australia ordered that AGM Markets Pty Ltd (AGM), OT Markets Pty Ltd (OTM) and Ozifin Tech Pty Ltd (Ozifin) pay a total of $75 million in pecuniary penalties.

AGM has been ordered to pay $35 million, while OTM and Ozifin have each been ordered to pay $20 million.

AGM Markets was an ASIC licensed broker offering binary options trading primarily under the brand AlphaBinary. The group also had a CySEC licensed counterpart in Cyprus, called AGM Markets Ltd, which has since been renamed Maxigrid Ltd.

ASIC’s enforcement update report also outlines the increased resourcing to build its capability to pursue court outcomes. Comparing the 2018 and 2020 calendar years, ASIC has recorded a 64% increase in civil penalty proceedings as well as a 36% increase in the number of criminal proceedings commenced.

During the July to December 2020 period, ASIC also continued to progress its enforcement work related to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. The finalised ASIC investigations and court outcomes from the Royal Commission have so far resulted in a total of $77.65 million in imposed penalties.