ASIC approves 394 new Australian financial services and credit licenses in FY2020

The Australian Securities & Investments Commission (ASIC) today published a report on its licensing and professional registration activities for the period between July 2019 and June 2020.

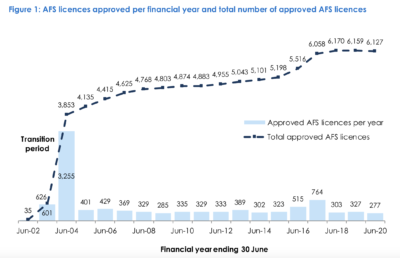

In the year to June 2020, ASIC received 1,500 licensing and professional registration applications (a slight decrease from 1,504 the previous year). This includes 1,346 Australian financial services (AFS) and credit licence applications. The regulator approved 394 new AFS and credit licences and 580 variation applications by AFS and credit licensees.

In addition, 361 AFS and credit licence applications were withdrawn or rejected for lodgement, four were refused, and 683 AFS and credit licences were cancelled and 40 suspended.

There have been major changes to licensing processes since the publication of ASIC’s last report on licensing and professional registration applications: July 2018 to June 2019. The most significant changes have arisen from the Stronger Regulators Act. The amendments came into effect on 18 February 2020.

The Stronger Regulators Act aligned the probity tests to be applied by ASIC when determining whether to grant a new or varied AFS or credit licence. The regulator is now required to have regard to a ‘fit and proper person’ test for AFS licence applications (prior to 18 February 2020 there was a ‘good fame and character’ test), and to apply the fit and proper person test to a wider range of people for both AFS and credit licence applicants.

These reforms require ASIC to consider all applicants against the fit and proper test and necessitate that all applicants provide additional information. In summary, the regulator requires an applicant to:

- list all of the people who are required to be a fit and proper person

- provide a statement of personal information signed by each of these people

- provide a criminal history check and bankruptcy check for each of these people.

In addition, the Stronger Regulators Act created a new power for ASIC to cancel an AFS or credit licence in the event that a licensee has not commenced operating a financial services business or engaged in credit activities within six months of the licence being granted.

Licensees are required to notify ASIC of a failure to commence operations within six months. Notably, ASIC does not expect licensees who have commenced providing some, but not all, of the products and services authorised under its licence to provide a notification.

Furthermore, on April 1, 2020, a new regulatory framework for foreign financial services providers (FFSPs) entered into force. As a result, FFSPs can now apply to obtain a foreign AFS licence to provide financial services in Australia to wholesale clients. To be eligible, the foreign provider must be authorised under an overseas regulatory regime that ASIC has assessed as sufficiently equivalent to the Australian regulatory regime.

An applicant for a foreign AFS licence is subject to a streamlined licensing assessment and is exempt from certain obligations that apply to other AFS licensees, such as financial and organisational competence requirements.

Foreign providers currently relying on pre- existing relief will have a two-year transition period until 31 March 2022 to make arrangements to continue their operations in Australia, which may include applying for a foreign AFS licence.