Tradefeedr’s data and analytics platform integrates with MarketFactory

MarketFactory, part of ION Markets, a leading global provider of trading, analytics, and risk management solutions for capital markets, has announced a new partnership with Tradefeedr, the Michael Spencer-backed FX data and analytics provider.

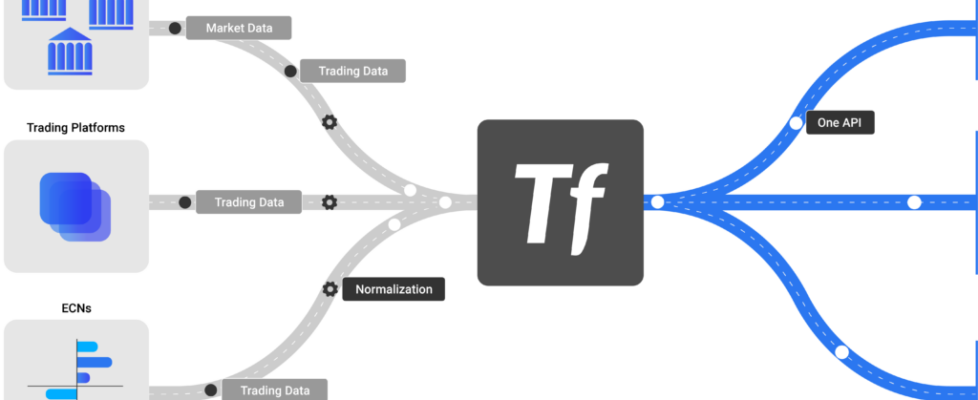

The agreement will see Tradefeedr’s data and analytics platform fully integrated within MarketFactory, enabling clients to review their trading markouts, impacts, and spreads directly with liquidity providers, using a common platform and shared data sets. Tradefeedr’s data analytics solution will be available as an add-on to new and existing customers using the award-winning MarketFactory service.

Tradefeedr has created a common, independent FX trading database allowing market participants across the sell-side, buy-side, regional banks, hedge funds, brokers, and central banks to connect, analyze their trading data, and collaborate. In June Tradefeedr launched its FX data analytics platform with more than 15 leading sell-side and 20 major buy-side firms onboarding and another 20 in the pipeline.

Eugene Markman, MarketFactory Chief Executive Officer said:

“MarketFactory’s partnership with Tradefeedr will broaden our offering to clients, providing shared data sets through one unified platform. The combination of MarketFactory’s end-to-end connectivity and Tradefeedr’s unified, analysis-ready data is a compelling proposition in a market where real-time data-driven decision-making is key.”

Balraj Bassi, Co-Founder of Tradefeedr added:

“I’m very excited by the possibilities this strategic partnership offers both Tradefeedr and MarketFactory clients. Our platform delivers significant benefits to market participants, through improving collaboration, and giving better access to trading information, providing greater transparency and trust in the market.”

ION Markets provides transformative technology and solutions to financial institutions dealing in equities, fixed income, foreign exchange, cleared derivatives and secured funding. Its solutions simplify clients’ operations by automating the full trade lifecycle, providing tools to manage risk, and maximizing access to liquidity, while giving real-time access to critical information required for timely operational decisions and execution on a global scale. MarketFactory is a financial technology company that provides software-as-a-service to currency markets. Customers gain access to the entire market, no matter the location, workflow, protocol, instrument, or liquidity provider. Its flagship product, Whisperer, is a single API that connects to more than 100 FX APIs.

Tradefeedr was established in 2018 by Balraj Bassi and Alexei Jiltsov, who had previously worked together at Lehman Brothers and launched Blacktree, a macro systematic hedge fund. In December 2020 Tradefeedr received $3 million in funding from IPGL, the private investment company owned by Lord Michael Spencer, the founder of global markets company ICAP plc and subsequently financial technology business, NEX plc. Seth Johnson, former CEO of NEX Markets, also supported the fund raising and was appointed as Tradefeedr’s Chairman. Tradefeedr aims to level the trading analytics playing field by allowing the sell-side to submit trading data on behalf of their buy-side clients. With better-standardised data, Tradefeedr transforms the way in which market participants interact with each other and deliver new insights and better decision making for all users.