PrimeXM adds trade order routing features to XCore

Forex technology and MT4/MT5 integration specialist PrimeXM has announced that it has added two new features to its existing XCore order management, risk and reporting solution, at the XCore portal portal.primexm.com. Both functionalities are related to order routing to trade execution providers, which enable XCore users to implement more dynamic hedging strategies via the XCore.

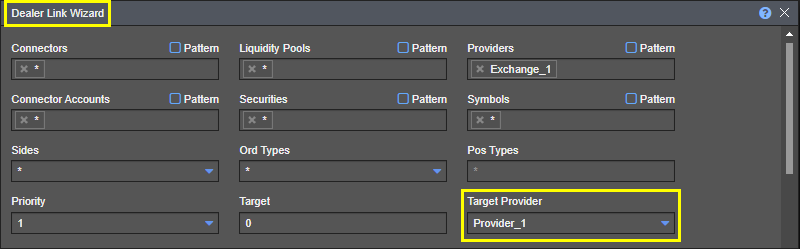

1) Dealer Link – Target Provider Function

PrimeXM has added a new “Target Provider” function in the Dealer Link component (accessed via Pending Config) that allows orders to be routed to a specific liquidity provider for order routing and execution, while price feeds could be coming from a different provider(s).

As more brokers diversify the product offerings to exchange-traded products (Stocks, CFDs on Stocks, Futures) or create derivative CFDs based on listed products, this function would enable Brokers to combine an independent market data vendor (CBOE, ICE Data Services, Refintiv, Trading Technologies) for pricing only, while routing and executing orders to an execution broker/provider.

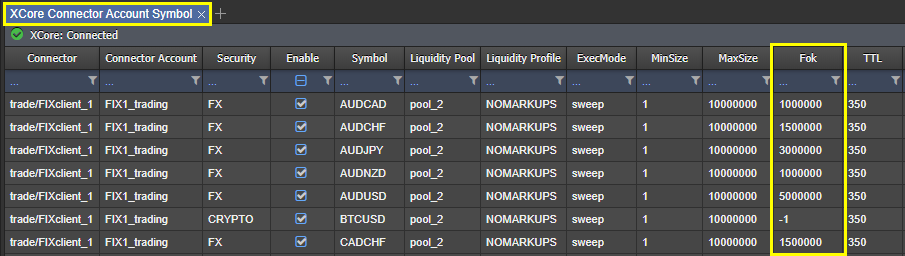

2) Combine Sweep and FOK – Hybrid Execution Mode in Connector Account Setting

Spot FX/Metals Liquidity is very fragmented and when executing larger orders, very often multiple Liquidity Providers (LPs) are utilized while “sweeping” through the liquidity book. The price and liquidity are affected and this is known as “market impact”. When over aggregating LPs that are not following similar execution behavior (sweeping vs full amount execution), then execution could lead to further worsen metrics. Many LPs, cover their risk immediately on the market, which could further result in more rejections and more re-tries attempts, time of execution to increase, spreads to be negatively affected. The end result is a worse execution and experience for the end Client.

Newly added “FOK” setting in the “Connector Account Setting” component provides the flexibility for XCore Users to change the execution mode automatically based on order size from Sweep to Single_FOK on an individual symbol basis. Brokers can now define a larger threshold amount (in “FOK” column), where any larger orders above the FOK threshold, will be routed automatically by the XCore to a single LP and attempted to execute once as a “Single FillorKill (FOK)” execution-style. Such execution will minimize the market impact, improve execution speed, and reduce rejections. Brokers are now able to combine Sweeping LPs (for smaller sizes) and Full Amount feeds/ LPs into the same Liquidity Pool and improve their execution quality for their clients while improving their relationships with LPs.

PrimeXM said that it is essential to have prior agreements with the executing broker/provider on whether such full amount executions are supported on their side before making any changes on the XCore to avoid unnecessary rejections of clients’ orders.