Cboe Silexx enhances Risk Radar

Cboe Silexx, a multi-asset order execution management system (OEMS) that caters to the professional marketplace, announces a set of enhancements as part of version 23.11.

Risk Radar has been given a bold new look, drawing the user’s attention to the most extreme upside and downside P&L range for each account, underlying, or individual position.

Within Risk Radar, users holding VIX index options can now see the associated futures contract alongside each position that Greeks and P&L shocks are calculated from.

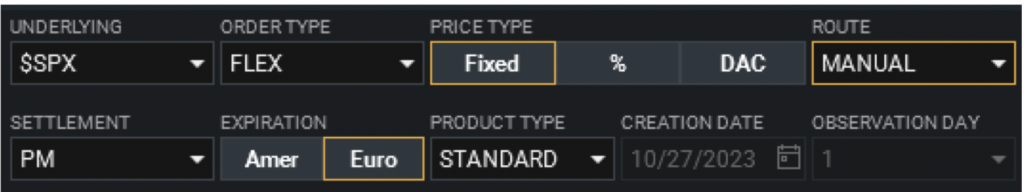

Users trading FLEX Options within Cboe Silexx will now see the MANUAL route available within a FLEX order ticket’s Route dropdown. After submitting an order to MANUAL, right-click on the submitted order and select ‘Add Fill’ to manually report fills. Note that the MANUAL route will only appear when selecting an order type of ‘FLEX’ and price type of ‘Fixed’.

All tickets now support auto-completion within the Client ID dropdown field. When typing into this field, auto-completion will attempt to match the characters entered with a value in the dropdown. Tab out of the field to make a selection once auto- complete finds a desired match.

Similar to the option chain, complex order book, and charting modules, all order tickets (except QT) will now display the icon + ticker if the ticket is docked as a tab within the application.

Users now have the choice to enable or disable setting their order quantity when clicking on a size tile within the market depth area of the order ticket. The setting comes disabled by default. To enable this feature, navigate to the order ticket settings and enable “Set order QTY when clicking size within depth”.