OFX sees revenues rebound in Q3 FY21

International money services provider OFX Group Limited (ASX:OFX) today posted an update for the third quarter of fiscal year 2021, that is, the three months ended December 31, 2020.

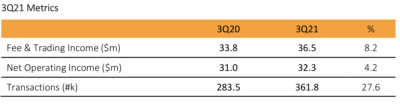

The company saw a good recovery across all segments in Q3 FY21, with Fee & Trading Income (revenue) up 10.2% on the preceding quarter to $36.5 million. The result was up 8.2% on the year-ago quarter.

In Corporate, strong client engagement saw an improvement in revenue, up 11.2% from the preceding quarter and 17.9% from the year-ago quarter. Online Sellers had another strong quarter, with revenue up 3.3% on 2Q21, and 9.9% on the same quarter a year earlier. While Consumer revenue was down 3.6% compared to the corresponding period a year earlier, it was up 5.5% on 2Q21 as the segment continued to rebound.

OFX notes that, across the regions, good revenue growth in North America and A&NZ was partially offset by ongoing challenges in the UK/European markets.

Overall Net Operating Income (NOI) was up 4.2% to $32.3 million from the year-ago period, driven by strong transaction growth.

Transactions were up 27.6% as OFX continued to win higher-value clients who trade more frequently and at higher ATVs, particularly in its Corporate segment. This is evidenced by a further recovery in ATVs relative to 2Q21, as expected, although these are still down 12.7% to $19,000 on the year-ago period at a group level.

Corporate new dealing clients were up 12.0% compared to a year earlier, while revenue from new Corporate clients was up 8% from the year-ago periood, and up 32% across North America and A&NZ.

Skander Malcolm, CEO of OFX, said:

“In what has been one of the most uncertain periods for economies worldwide, the growth in revenue is testament to the high degree of client support. The recovery in Consumer client activity and further growth in Corporate revenue, gives us a great deal of confidence in the strength of the business for the remainder of the year and beyond.

While the near-term revenue outlook remains difficult to predict, we expect this positive momentum to continue through 4Q21 although it is unlikely to exceed 4Q20, which saw exceptionally high trading volumes related to COVID-19. 4Q20 NOI was up 16.3% on 4Q19. Cost management is in line with expectations and the business continues to generate strong cash flows.”