Freemarket granted Ireland license to drive EU expansion

London-based B2B cross-border payments and currency exchange provider Freemarket has announced that it has been granted a Payment Institution license from the Central Bank of Ireland, unlocking the company’s next stage of expansion across Europe.

Freemarket said that having received the approval by the Central Bank of Ireland, the company now has market access to the entire European Economic Area (EEA) where there are an estimated 24.4m small to mid-size businesses (SMBs) operating across the EU, representing 99% of all businesses in the region. With the B2B cross-border payment market set to grow globally by 43% by 2030, Freemarket has identified the opportunity to serve these European SMBs that are underserved by traditional banks.

The regulatory authorisation will also see Freemarket’s operations in Ireland expand. Having already opened an office in Dublin to house their growing team, Freemarket will be looking to partner with European banks, nonbanking financial institutions and foreign currency providers to support its European expansion.

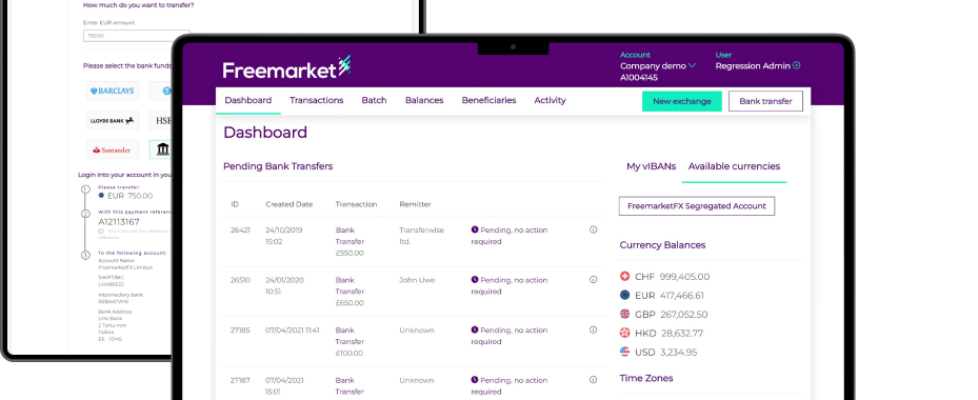

Founded in 2010, Freemarket works with SMBs globally to accelerate their growth, by giving them access to cross-border payments and currency exchange services that are far more optimised to their needs than those of institutional banks. Through the use of Application Programming Interface (API) technology, Freemarket both automates the full lifecycle of cross border payments and consolidates the entire process onto a single platform, thereby tackling the high costs, lack of transparency and legacy technology issues that have traditionally undermined the cross-border payments space.

Many forex companies have traditionally struggled to acquire support from traditional banks in the handling of offshore jurisdictions, whilst also facing challenges moving funds out of exotic markets. Freemarket’s platform directly tackles these legacy issues, enabling forex issuers to transfer money faster, cheaper and with more support than through a traditional banking institution.

Having started as a foreign exchange matching platform, Freemarket today offers cloud-based cross-border payment solutions to over 300 corporate clients, including dozens of forex companies, enabling them to execute payments in over 100 countries. The company has achieved a record sales growth of 361% over the last three years and processed over £4 billion in transactions in 2022. The company has been named in The Sunday Times 100 Fastest Growing UK private companies, Deloitte’s Tech Fast 50 and the FT1000.

Stephen Fletcher, CEO Ireland for Freemarket said:

Stephen Fletcher, CEO Ireland for Freemarket said:

“When Freemarket was founded in 2010 the mission was simple: to improve access for SMB’s to cross-border payment capabilities, thereby empowering them to maximise their revenues and accelerate their growth; today, we remain committed to this mission. We are delighted that our new Irish Payment Institution licence will enable us to expedite our mission to make cross-border payments faster, more affordable and more transparent for millions of European businesses, including forex firms.”

About Freemarket

Freemarket works with small to mid-sized businesses globally to accelerate their growth by giving them access to cross-border payments and currency exchange optimised for their treasury and operational needs to streamline processes, remove complexity and increase efficiency. The company enables businesses to unlock more currencies and markets through a single, API-enabled connection point and platform, while ensuring they can more efficiently move funds internationally and access an entire correspondent banking and payments network. Combining banking and payments service aggregation and integrated technology, Freemarket makes it faster and easier for businesses to move money around the world.