JPMorgan reports drop in Markets & Securities Services revenue in Q2 2021

JPMorgan Chase & Co. (NYSE:JPM) today posted its financial results for the second quarter of 2021, with Markets & Securities Services revenue markedly down from the year-ago quarter.

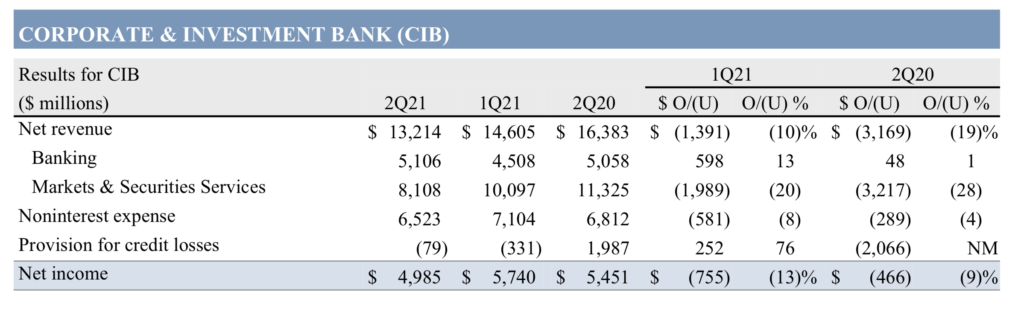

Markets & Securities Services revenue was $8.1 billion, down 28% from a year earlier. Markets revenue was $6.8 billion, down 30%. Fixed Income Markets revenue was $4.1 billion, down 44%, driven by lower revenue across products as compared with a favorable performance in the prior year.

Equity Markets revenue was $2.7 billion, up 13%, driven by strong performance across products.

Securities Services revenue was $1.1 billion, down 1%, driven by deposit margin compression, predominantly offset by growth in deposits and fees.

Across all segments, net income for the second quarter of 2021 was $11.9 billion, up $7.3 billion from a year earlier, driven by credit reserve releases of $3.0 billion compared to credit reserve builds of $8.9 billion in the prior year.

Net revenue of $31.4 billion was down 7% from the year-ago quarter. Noninterest revenue was $18.5 billion, down 7%, due to lower CIB Markets revenue and $678 million of markups on held-for-sale positions in the bridge book recorded in the prior year, largely offset by higher Investment Banking fees in CIB, higher Card income and higher AWM management fees.

Net interest income was $12.9 billion, down 8%, predominantly due to lower net interest income in CIB Markets and lower loans in Card.

Noninterest expense was $17.7 billion, up 4%, largely reflecting continued investments in the business including technology and front office hiring.