JPMorgan registers steep increase in Markets & Securities Services revenue in Q1 2021

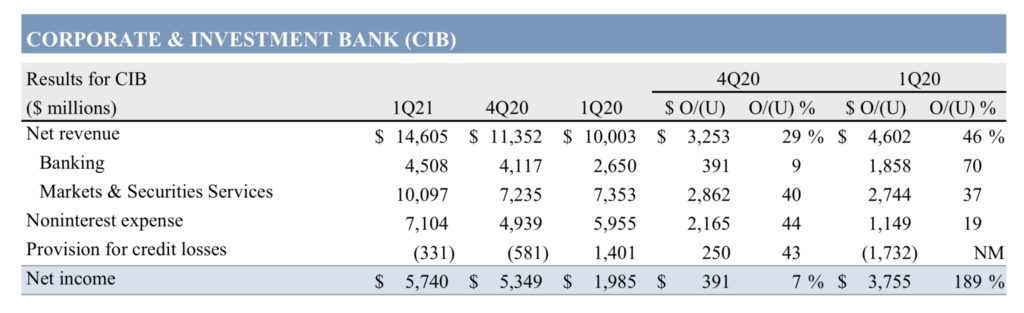

JPMorgan Chase & Co. (NYSE:JPM) today posted its financial results for the first three months of 2021, with Markets & Securities Services revenue sharply up.

During the first quarter of 2021, Markets & Securities Services revenue was $10.1 billion, up 37% from a year earlier. The result was also higher than in the final quarter of 2020.

Markets revenue was $9.1 billion, up 25%. Fixed Income Markets revenue was $5.8 billion, up 15%, predominantly driven by strong performance in Securitized Products and Credit, largely offset by lower revenue in Rates and Currencies & Emerging Markets against a favorable performance in the prior year. Equity Markets revenue was $3.3 billion, up 47%, driven by strong performance across products. Securities Services revenue was $1.1 billion, down 2%, with deposit margin compression largely offset by deposit balance growth.

Credit Adjustments & Other was a loss of $3 million, compared to a loss of $951 million in the prior year which was predominantly driven by funding spread widening on derivatives.

Across all segments, net income for the first quarter of 2021 was $14.3 billion, up $11.4 billion, predominantly driven by credit reserve releases of $5.2 billion compared to credit reserve builds of $6.8 billion in the prior year.

Net revenue of $33.1 billion was up 14%. Noninterest revenue was $20.1 billion, up 39%, driven by higher CIB Markets revenue, higher Investment Banking fees, and the absence of losses in Credit Adjustments and Other and markdowns on held-for-sale positions in the bridge bookrecorded in the prior year. Net interest income was $13.0 billion, down 11%, predominantly driven by the impact of lower rates, partially offset by balance sheet growth.

The provision for credit losses was a net benefit of $4.2 billion driven by net reserve releases of $5.2 billion, compared to an expense of $8.3 billion in the prior year predominantly driven by net reserve builds of $6.8 billion. The Consumer reserve release was $4.5 billion, and included a $3.5 billion release in Card, reflecting improvements in the macroeconomic scenarios, and a $625 million reserve release in Home Lending primarily due to improvements in house price index (HPI) expectations and to a lesser extent portfolio run-off. The Wholesale reserve release was $716 million reflecting improvements in the macroeconomic scenarios.

Net charge-offs of $1.1 billion were down $412 million, predominantly driven by Card.