JPMorgan registers 18% Y/Y increase in Markets & Securities Services revenue in Q4 2020

JPMorgan Chase & Co. (NYSE:JPM) today posted its financial metrics for the final quarter of 2020, with net income sharply up from a year earlier.

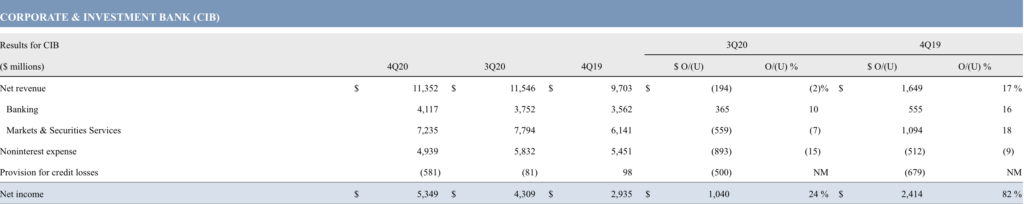

In Corporate & Investment Banking, net income for the fourth quarter of 2020 was $5.3 billion, up 82%, with revenue of $11.4 billion, up 17% from the corresponding period in 2019.

Banking revenue was $4.1 billion, up 16%. Investment Banking revenue was $2.5 billion, up 37%, driven by higher Investment Banking fees, up 34%, reflecting higher fees across products.

Markets & Securities Services revenue was $7.2 billion in the fourth quarter of 2020, up 18% from a year earlier.

Markets revenue was $5.9 billion, up 20%. Fixed Income Markets revenue was $4.0 billion, up 15%, driven by strong performance in Credit, Currencies & Emerging Markets and Commodities. Equity Markets revenue was $2.0 billion, 32% higher than a year earlier, predominantly driven by strong client activity in derivatives and Cash Equities.

Securities Services revenue was $1.1 billion, down 1%, with deposit margin compression predominantly offset by balance growth. Credit Adjustments & Other was a gain of $243 million largely driven by funding and credit spread tightening on derivatives.

Across all segments, net income was $12.1 billion, marking an increase of 42% from the fourth quarter of 2019. The rise largely reflected credit reserve releases of $2.9 billion.

Net revenue for the fourth quarter of 2020 amounted to $30.2 billion, up 3% from the year-ago quarter. Noninterest revenue was $16.8 billion, up 13%, predominantly driven by higher Investment Banking fees, net gains on certain legacy equity investments in Corporate compared to net losses in the prior year, and higher net production revenue in Home Lending.

Net interest income was $13.4 billion, down 7%, predominantly driven by the impact of lower rates as well as balance sheet mix, largely offset by balance sheet growth and higher net interest income in CIB Markets.

The provision for credit losses was a net benefit of $1.9 billion, compared to an expense of $1.4 billion in the prior year driven by reserve releases in the current quarter. The Wholesale reserve release was $2.0 billion, reflecting an improvement in the macro-economic scenarios and the continued ability of clients to access liquidity and capital markets. The Consumer reserve release was $0.9 billion, in Home Lending, primarily due to improvements in HPI expectations and portfolio run-off.

The prior year included a net reserve release in the Consumer portfolio and a net reserve build in the Wholesale portfolio. Net charge-offs of $1.1 billion were down $444 million from the prior year, driven by Card.

Jamie Dimon, Chairman and CEO, commented on the financial results:

“JPMorgan Chase reported strong results in the fourth quarter of 2020, concluding a challenging year where we generated record revenue, benefiting from our diversified business model and dedicated employees. While we reported record profits of $12.1 billion, we do not consider the reserve takedown of $2.9 billion to represent core or recurring profits – essentially reserve calculations, while done extremely diligently and carefully, now involve multiple, multi-year hypothetical probability-adjusted scenarios, which may or may not occur and which can be expected to introduce quarterly volatility in our reserves”.

“While positive vaccine and stimulus developments contributed to these reserve releases this quarter, our credit reserves of over $30 billion continue to reflect significant near-term economic uncertainty and will allow us to withstand an economic environment far worse than the current base forecasts by most economists,” Jamie Dimon concluded.