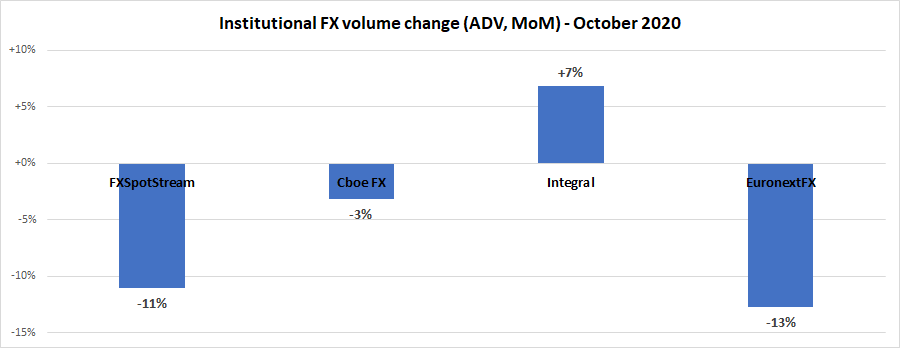

Institutional FX volumes weak in October, average -5% MoM

Following a fairly strong September, institutional FX traders returned somewhat to the sidelines in October ahead of what may be a volatile November, highlighted by this week’s US Presidential election.

Overall, institutional FX volumes dipped by about 5% in October, based on our analysis (see below) of figures reported by institutional FX platforms Cboe FX, EuronextFX, FXSpotStream, and Integral Development Corp. Three of the four registered decreased activity in October – two by double digit percent – with only Integral seeing a rise in trading volume during the month.

Cboe FX (formerly HotspotFX)

- October 2020 total volumes $681 billion, or ADV $30.94 billion, -3% MoM

EuronextFX (formerly FastMatch)

- October 2020 ADV $18.6 billion, -13% below September’s ADV $$21.3 billion.

FXSpotStream

- FXSpotStream’s ADV $38.885 billion, MoM (Oct ’20 vs Sep ’20) decreased -11.0%

- FXSpotStream’s ADV YoY (Oct’19 vs Oct’20) increased 16.56%

- FXSpotStream’s 2020 ADV (Jan-Sep) of USD42.455billion, is up 14.85% when compared to the same period during 2019 of USD36.965 billion

Integral

- Average daily volumes (ADV) across Integral platforms totaled $43.8 billion in October 2020. This represents an increase of 6.8% compared to September 2020, and an increase of 20.3% compared to the same period in 2019.

- From October 2020, reported ADV include volumes traded on the recently launched venue, TrueFX, and is reported in aggregate with volumes from Integral’s other trading platforms. Reported monthly ADV now represents total volumes traded across the group’s entire liquidity network.