HSBC recognises provisional gain of $1.5bn on acquisition of SVB UK

HSBC today posted its financial report for the first quarter of 2023.

Profit before tax rose by $8.7 billion to $12.9 billion. This included a $2.1bn reversal of an impairment relating to the planned sale of HSBC’s retail banking operations in France, as the completion of the transaction has become less certain, and a provisional gain of $1.5 billion on the acquisition of Silicon Valley Bank UK Limited (SVB UK) in March.

In March 2023, HSBC UK acquired SVB UK. The acquisition will be funded from existing resources and brings the staff, assets and liabilities of SVB UK into the HSBC portfolio.

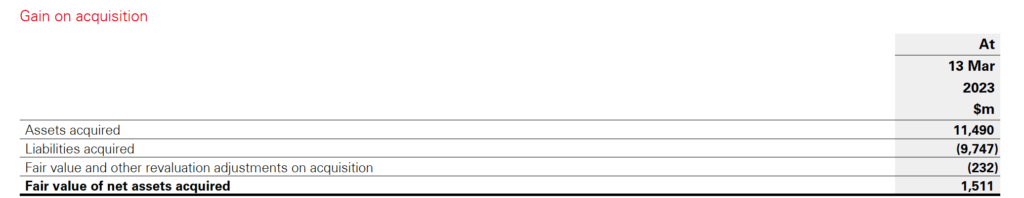

On acquisition, HSBC performed a preliminary assessment of the fair value of the assets and liabilities purchased. It established an opening balance sheet on 13 March 2023 and applied the result of the fair value assessment, which resulted in a reduction in net assets of $0.2bn.

The provisional gain on acquisition of $1,511m represents the difference between the consideration paid of £1 and the net assets acquired. This gain could change as further due diligence is performed.

At 31 March 2023, the funding provided to SVB UK by HSBC UK was $2.8bn. After initial deposit outflows following the acquisition of SVB UK, deposits are now stabilising, and client exits have been minimal.

Customer accounts at HSBC increased by $34bn in the quarter. On a constant currency basis, customer accounts increased by $21bn, mainly as $23bn of balances associated with HSBC’s retail banking operations in France were reclassified from held for sale during the period.

In addition, HSBC’s acquisition of SVB UK resulted in growth of $8bn.

Excluding these factors, deposits fell by $10bn or 0.6%, reflecting outflows in HSBC UK as customers utilised surplus deposits, as well as in Commercial Banking (‘CMB‘) and Global Banking and Markets (‘GBM‘) in Hong Kong.