Goldman Sachs registers 23% Y/Y rise in Global Markets revenues in Q4 2020

The Goldman Sachs Group, Inc. (NYSE:GS) today reported its financial metrics for the final quarter and full year 2020.

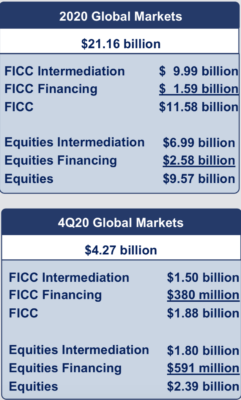

In the fourth quarter of 2020, net revenues in Global Markets were $4.27 billion, 23% higher than the fourth quarter of 2019 and 6% lower than the third quarter of 2020.

In the fourth quarter of 2020, net revenues in Global Markets were $4.27 billion, 23% higher than the fourth quarter of 2019 and 6% lower than the third quarter of 2020.

Net revenues in FICC were $1.88 billion, 6% higher than the fourth quarter of 2019, due to higher net revenues in FICC intermediation, reflecting significantly higher net revenues in credit products and commodities and higher net revenues in currencies. The rise was partially offset by significantly lower net revenues in interest rate products and lower net revenues in mortgages. Net revenues in FICC financing were essentially unchanged.

Net revenues in Equities were $2.39 billion in the fourth quarter of 2020, 40% higher than the fourth quarter of 2019, due to significantly higher net revenues in Equities intermediation, reflecting significantly higher net revenues in both derivatives and cash products. Net revenues in Equities financing were lower, reflecting higher net funding costs, including the impact of lower yields on the firm’s global core liquid assets.

For 2020, net revenues in Global Markets were $21.16 billion, 43% higher than 2019. Net revenues in FICC were $11.58 billion, 57% higher than 2019, primarily due to significantly higher net revenues in FICC intermediation, reflecting significantly higher net revenues across all major businesses. In addition, net revenues in FICC financing were higher, driven by repurchase agreements.

Net revenues in Equities were $9.57 billion in 2020, 30% higher than 2019, due to significantly higher net revenues in Equities intermediation, reflecting significantly higher net revenues in both derivatives and cash products. Net revenues in Equities financing were lower, primarily reflecting higher net funding costs, including the impact of lower yields on the firm’s global core liquid assets.

Across all segments, net revenues were $44.56 billion for 2020, 22% higher than 2019, reflecting significantly higher net revenues in Global Markets and Investment Banking and higher net revenues in Consumer & Wealth Management, partially offset by lower net revenues in Asset Management.

Net revenues were $11.74 billion for the fourth quarter of 2020, 18% higher than the fourth quarter of 2019 and 9% higher than the third quarter of 2020. The increase compared with the fourth quarter of 2019 reflected higher net revenues across all segments, including significant increases in Global Markets and Investment Banking.

Diluted earnings per common share (EPS) was $24.74 for the year ended December 31, 2020 compared with $21.03 for the year ended December 31, 2019, and was $12.08 for the fourth quarter of 2020 compared with $4.69 for the fourth quarter of 2019 and $8.98 for the third quarter of 2020.

On January 15, 2021, the Board of Directors of The Goldman Sachs Group, Inc. declared a dividend of $1.25 per common share to be paid on March 30, 2021 to common shareholders of record on March 2, 2021.