Goldman Sachs registers 29% Y/Y increase in Global Markets revenues in Q3 2020

The Goldman Sachs Group, Inc. (NYSE:GS) today released its financial report for the third quarter of 2020, with the Global Markets segment showing robust performance.

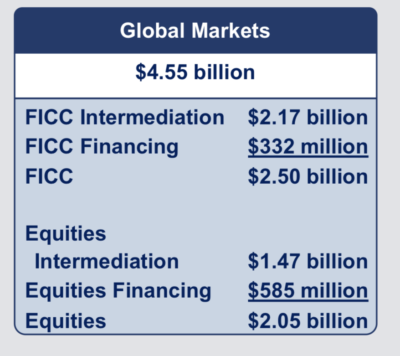

Global Markets generated quarterly net revenues of $4.55 billion, reflecting continued strength in Fixed Income, Currency and Commodities (FICC) and Equities. The net revenues result represents a rise of 29% from the third quarter of 2019. However, the result is 37% lower the one registered in the second quarter of 2020.

Global Markets generated quarterly net revenues of $4.55 billion, reflecting continued strength in Fixed Income, Currency and Commodities (FICC) and Equities. The net revenues result represents a rise of 29% from the third quarter of 2019. However, the result is 37% lower the one registered in the second quarter of 2020.- Net revenues in FICC were $2.50 billion, 49% higher than the third quarter of 2019, due to significantly higher net revenues in FICC intermediation. These reflected significantly higher net revenues in interest rate products, mortgages, commodities and credit products, while net revenues in currencies were essentially unchanged.

- Net revenues in FICC financing were lower, due to lower net revenues in structured credit financing and repurchase agreements.

- Net revenues in Equities were $2.05 billion, 10% higher than a year earlier, due to significantly higher net revenues in Equities intermediation. This was due to significantly higher net revenues in derivatives, partially offset by lower net revenues in cash products. In addition, net revenues in Equities financing were markedly lower, due to higher net funding costs, including the impact of lower yields on the firm’s global core liquid assets.

Across all business segments, Goldman Sachs reported net revenues of $10.78 billion and net earnings of $3.62 billion for the quarter ended September 30, 2020. Net revenues were $32.82 billion and net earnings were $5.20 billion for the first nine months of 2020.

Diluted earnings per common share (EPS) was $9.68 for the third quarter of 2020 compared with $4.79 for the third quarter of 2019 and $0.53 for the second quarter of 2020, and was $13.34 for the first nine months of 2020 compared with $16.32 for the first nine months of 2019.

Annualized return on average common shareholders’ equity (ROE) was 17.5% for the third quarter of 2020 and 8.0% for the first nine months of 2020. Annualized return on average tangible common shareholders’ equity (ROTE) was 18.6% for the third quarter of 2020 and 8.5% for the first nine months of 2020.

During the first nine months of 2020, the firm recorded net provisions for litigation and regulatory proceedings of $3.15 billion, which reduced diluted EPS by $8.77 and reduced annualized ROE by 5.1 percentage points.