Euronext FX trading revenue increases 27.6% Y/Y in Q2 2022

Euronext has just reported its financial results for the second quarter of 2022, with Forex revenues marking a rise from the year-ago period and the preceding quarter.

FX trading reported revenue at €7.3 million in the three months to end-June 2022, up 27.6% from Q2 2021. Euronext FX trading volumes and revenue benefited from the continued positive momentum started in Q1 2022 with heightened volatility.

Over the second quarter of 2022, average daily volumes of US$23.6 billion were recorded, up +27.0% compared to Q2 2021.

On a like-for-like basis at constant currencies, FX trading revenue was up 12.8% in Q2 2022 compared to Q2 2021.

Across all segments, Q2 2022 revenue and income grew 2.5% pro forma, compared to Q2 2021 underlying revenue and income, to €374.7 million (+14.0% reported, +€45.9 million) driven by the growth of non-volume related business and trading activities.

Contribution of the Borsa Italiana Group to revenue was €129.2 million.

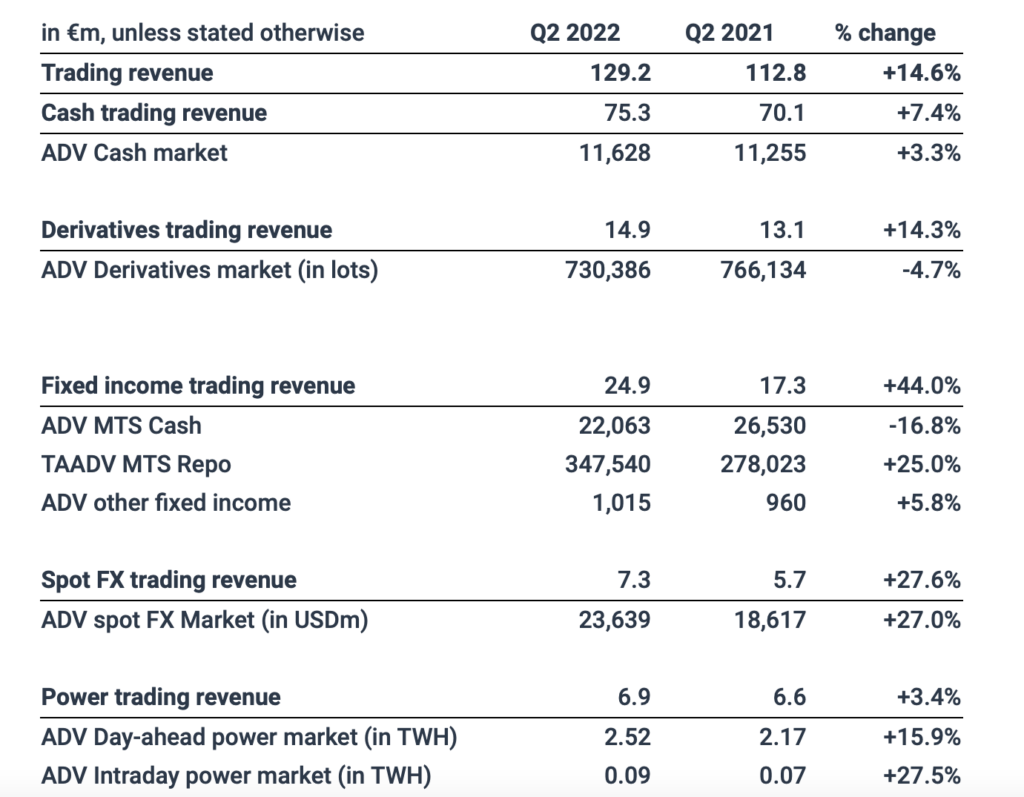

Trading revenue grew to €129.2 million (+3.7% pro forma, +14.6% reported), resulting from a robust performance across all asset classes in a volatile market environment. Cash trading revenue was €75.3 million (+1.4% pro forma, +7.4% reported), reflecting strong revenue capture, and fixed income trading revenue was €24.9 million (+2.4% pro forma, +44.0 % reported).

Post-trade revenue grew to €93.9 million (+1.8% pro forma, +12.6% reported). Clearing revenue increased to €31.4 million (+5.5% pro forma, +18.0% reported) as a result of a volatile environment and net treasury income of Euronext Clearing was €15.7 million.

Custody and Settlement revenue was €62.5 million (+0.1% pro forma, +10.1% reported) thanks to the resilience of the diversified Euronext Securities business model in a normalising settlement environment.

Reported net income, share of the parent company shareholders, rose 25.6% pro forma (+37.2% reported) to €118.9 million (+€32.2 million).

Stéphane Boujnah, Chief Executive Officer and Chairman of the Managing Board of Euronext, said:

“This second quarter of 2022 was marked by the continuation of the volatile environment seen since the first quarter of the year. Euronext’s business model again demonstrated its resilience, and generated solid growth in revenue, adjusted EBITDA and adjusted net income.

A key milestone in our ‘Growth for Impact 2024’ strategic plan was achieved with the successful migration of our Core Data Centre from Basildon, near London, to a fully green data centre in Bergamo, near Milan. This migration enables Euronext to deliver the first revenue synergies targeted under our 2024 strategic plan. This success paves the way to the migration of Italian cash and derivatives markets to the Euronext state-of-the-art European proprietary trading platform Optiq® by 2023. In addition, we pursued our integration work and we reached €24.1 million cumulated run-rate annual synergies in relation to the acquisition of the Borsa Italiana Group at the end of Q2 2022, 14 months after the closing of the transaction.