Euronext registers 18% Y/Y increase in FX trading revenue in Q1 2022

Euronext has just reported its financial results for the first quarter of 2022, with Forex revenues marking a rise from the year-ago period.

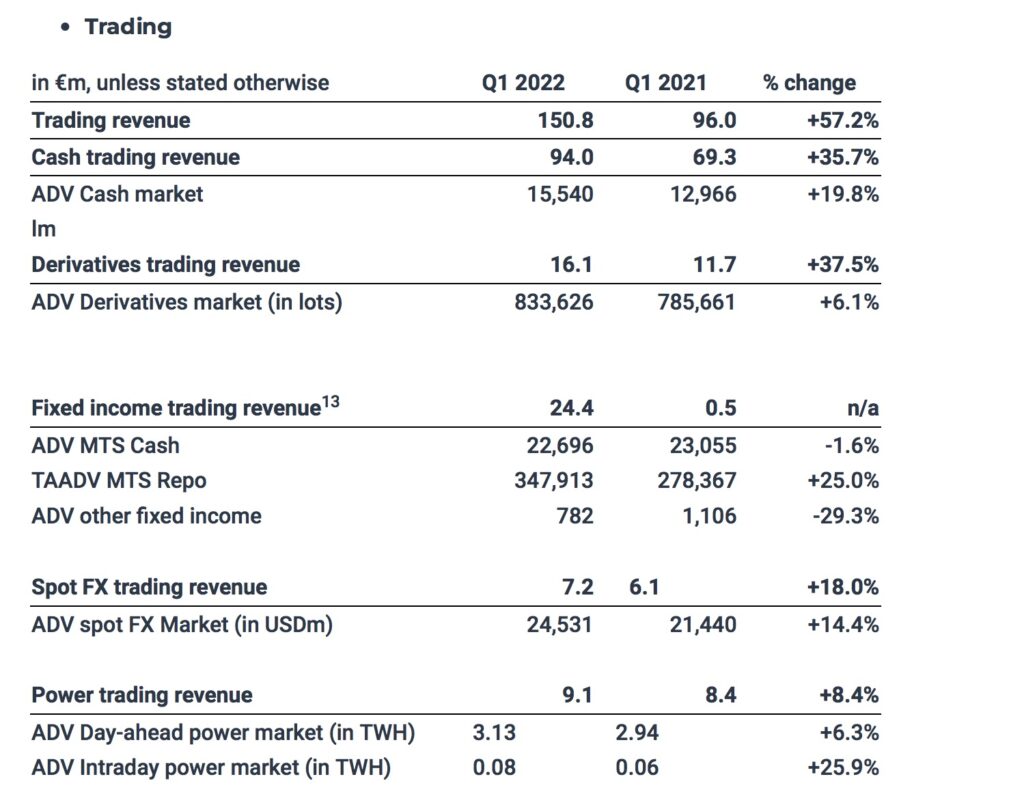

FX trading reported revenue amounted to €7.2 million in Q1 2022, up 18.0% from Q1 2021. The first quarter of 2022 was the second best quarter ever for Euronext FX (after Q1 2020) in terms of both revenue and average daily volumes, due to the positive impact of heightened overall volatility.

Over the first quarter of 2022, average daily volumes of US$24.5 billion were recorded, up 14.4% compared to Q1 2021.

On a like-for-like basis at constant currencies, FX trading revenue was up 9.9% in Q1 2022 compared to Q1 2021.

Derivatives trading revenue increased by 37.5% to €16.1 million in Q1 2022 as a result of the consolidation of Borsa Italiana capital markets, a high volatility environment and strong traction in commodity derivatives.

During the first quarter of 2022, average daily volume on financial derivatives was 744,912 lots, up 6.1% from Q1 2021 reflecting a high volatility environment for equity derivatives and strong retail participation. Euronext’s commodities franchise reported a record quarter, with average daily volumes on commodity derivatives at 88,714 lots, up 6.1% compared to an already strong Q1 2021.

Across all segments, in Q1 2022, Euronext consolidated revenue and income increased to €395.7 million, up massive 58.8%, resulting primarily from the consolidation of the Borsa Italiana Group, record trading activity supported by highly volatile market conditions and the strong performance of non-volume related businesses.

On a like-for-like basis and at constant currencies, Euronext consolidated revenue and income grew 6.9% in Q1 2022, to €266.3 million, compared to Q1 2021.

Despite strong trading revenue, non-volume related revenue accounted for 55% of total Group revenue in Q1 2022, compared to 58% pro forma in Q1 2021, reflecting the successful diversification toward non-volume related activities. The underlying operating expenses excluding D&A coverage by non-volume related revenue ratio was at 151% in Q1 2022, compared to 147% pro forma in Q1 2021.

Euronext saw net income, share of the parent company shareholders, increase by 46.5% in Q1 2022 compared to Q1 2021, to €143.8 million. This represents a reported EPS of €1.35 basic and €1.35 fully diluted in Q1 2022, compared to €1.29 basic and €1.29 fully diluted in Q1 2021.

Adjusted net income, share of the parent company shareholders was up 50.3% to €164.4 million. Adjusted EPS (basic) was up 7.3% in Q1 2022, at €1.54 per share, compared to an adjusted EPS (basic) of €1.44 per share in Q1 2021.

In Q1 2022, Euronext reported a net cash flow from operating activities of €368.6 million, compared to €185.9 million in Q1 2021, reflecting higher positive changes in working capital and the consolidation of the Borsa Italiana Group. Excluding the impact on working capital from Euronext Clearing (formerly CC&G) and Nord Pool CCP activities, net cash flow from operating activities accounted for 84% of adjusted EBITDA in Q1 2022.