Citi reports sharp drop in Markets and Securities Services revenues in Q2 2021

Citigroup Inc (NYSE:C) has just posted its financial results for the second quarter of 2021.

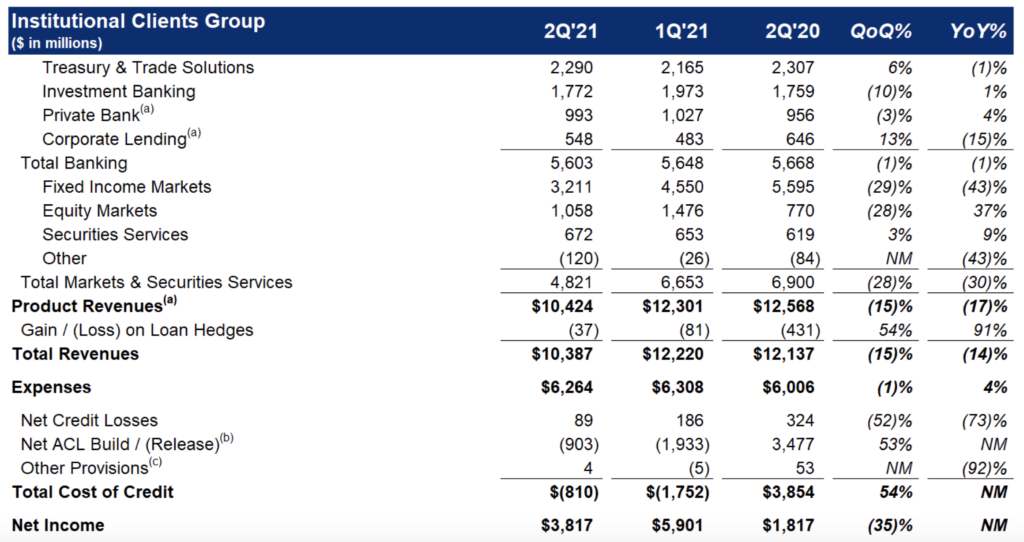

Institutional Clients Group (ICG) revenues for the second quarter of 2021 amounted to $10.4 billion, down 14% from the year-ago quarter. The drop reflected declines in Fixed Income Markets and Corporate Lending, partially offset by higher revenues in Equity Markets, the Private Bank and Securities Services.

Markets and Securities Services revenues of $4.8 billion decreased 30% from the year-ago quarter. The result was also markedly down from the result of $6.7 billion registered in the first quarter of 2021.

Fixed Income Markets revenues of $3.2 billion decreased 43% versus a strong prior-year period in both rates and spread products. Equity Markets revenues of $1.1 billion increased 37%, driven by strong performance in derivatives and prime finance, reflecting solid client activity and favorable market conditions.

Securities Services revenues of $672 million increased 9% on a reported basis and 5% in constant dollars, primarily reflecting growth in fee revenues, driven by growth in assets under custody and settlement volumes, partially offset by lower spreads.

ICG net income of $3.8 billion increased significantly, as the lower cost of credit more than offset the decline in revenues and higher expenses.

Across all segments, Citigroup reported net income for the second quarter 2021 of $6.2 billion, or $2.85 per diluted share, on revenues of $17.5 billion. This compared to net income of $1.1 billion, or $0.38 per diluted share, on revenues of $19.8 billion for the second quarter 2020.

Revenues decreased 12% from the prior-year period, primarily reflecting normalization in market activity in Fixed Income Markets within the Institutional Clients Group (ICG), along with lower average card loans in Global Consumer Banking (GCB), as well as the impact of lower interest rates.

Net income of $6.2 billion increased significantly from the prior-year period driven by the lower cost of credit. Earnings per share of $2.85 also increased significantly from the prior-year period, reflecting the growth in net income, as well as a slight decline in shares outstanding.