BGC Partners reports 11.6% Y/Y drop in FX revenues in Q1 2021

Global brokerage and financial technology company BGC Partners, Inc. (NASDAQ:BGCP) today posted its financial results for the first quarter of 2021.

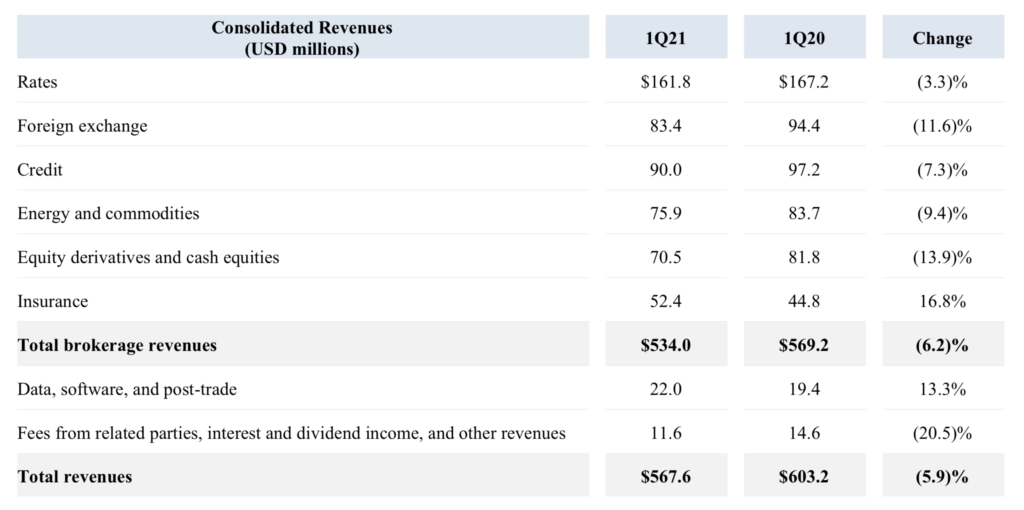

The company reported FX revenues of $83.4 million for the first quarter of 2021, down 11.6% from the result of $94.4 million reported for the equivalent quarter in 2020. The result, however, is better than the $73.2 million in FX revenues BGC reported for the final quarter of 2020.

For the first quarter of 2021, BGC reported total revenues of $567.6 million. Revenues and performance across the business was as follows: Voice / Hybrid, including other revenues and excluding Corant, generated revenues of $409.5 million with a pre-tax Adjusted Earnings margin of approximately 22% in the first quarter of 20216. Fenics reported record net revenues of $105.6 million, an improvement of 40%, with a pre-tax Adjusted Earnings margin of 30.2% in its Fenics Markets business. Corant also generated record revenues during the first quarter of $52.4 million, up 16.8%.

BGC recorded its second highest ever quarterly Rates brokerage revenues, second only to the year ago period. BGC had strong growth across U.S. and European rates, including inflation products and European government bonds. This growth was offset by lower activity across Sterling rates products. The first quarter of 2021 provided a favorable trading environment across many of the Rates products BGC brokers. Increasing U.S. interest rates, particularly in longer dated benchmarks, drove volatility higher and supported global Rates trading volumes.

Corant’s record performance was driven by improved productivity from recently hired brokers and hardening insurance pricing trends.

Fenics GO volumes increased by more than 300% in the first quarter, primarily driven by Euro Stoxx 50 and Nikkei 225 index options, along with recent launches of additional Asian and European index products. Estimated block-sized market share in front-month Euro Stoxx 50 and Nikkei 225 index options increased by 490 and 1,290 basis points to 5.7 percent and 13.0 percent, respectively.

Fenics brokerage revenues increased by 49.2% to $83.7 million, while Data, Software, and Post-trade revenues increased by 13.3% to $22.0 million.

On April 28, 2021, BGC Partners’ Board of Directors declared a quarterly qualified cash dividend of $0.01 per share payable on June 2, 2021 to Class A and Class B common stockholders of record as of May 19, 2021. The ex-dividend date will be May 18, 2021.