Bank of America marks rise in Global Markets sales and trading revenues in Q3 2020

Bank of America Corp (NYSE: BAC) today posted its financial results for the third quarter of 2020, with Global Markets revenues supported by stronger performance in mortgage and foreign exchange products.

- Global Markets saw net income increase $9 million from a year earlier to $857 million in the third quarter of 2020. Excluding net DVA, net income increased 10% year-on-year to $945 million.

- Global Markets’ revenue for the three months to end-September 2020 amounted to $4.3 billion, up 11% from the equivalent period a year earlier. This rise reflects increases in sales and trading, investment banking fees, and card income.

- Excluding net DVA, revenue increased 13%.

- Reported sales and trading revenue amounted to $3.2 billion. Excluding net DVA, sales and trading revenue increased 4% to $3.3 billion.

- FICC revenue increased 3% to $2.1 billion on the back of solid performance in mortgage and FX products. Equities revenue increased 6% to $1.2 billion, driven by increased client activity in Asia.

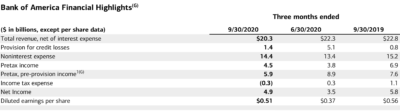

Across all segments, net income for the third quarter of 2020 amounted to $4.9 billion, or $0.51 per diluted share. This compares to net income of $5.8 billion, or $0.56 a year earlier.

Bank of America explains that the provision for credit losses increased to $1.4 billion due to COVID-19 impacts in commercial.

Revenue, net of interest expense, decreased 11% to $20.3 billion.

Net interest income (NII) was down 17% to $10.1 billion, driven by lower interest rates, whereas non-interest income declined 4% to $10.2 billion, primarily reflecting lower consumer fees as well as improved trading and investment banking results.

Loan and lease balances in the business segments rose $27 billion, or 3%, to $950 billion, whereas deposits rose $320 billion, or 23%, to $1.7 trillion.

Common equity tier 1 (CET1) ratio increased 50 basis points to 11.9% (Standardized approach), versus 9.5% required minimum.