Nasdaq marks strong growth in Solutions segments revenues in Q1 2022

Nasdaq, Inc. (NASDAQ:NDAQ) today reported financial results for the first quarter of 2022.

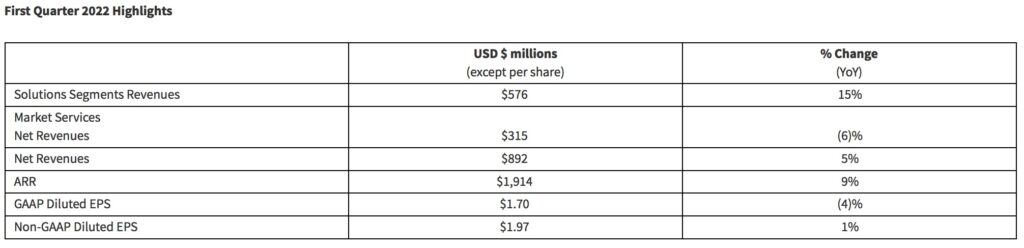

First quarter 2022 net revenues were $892 million, an increase of $41 million, or 5%, from $851 million in the prior year period. Net revenues reflected a $51 million, or 6%, positive impact from organic growth and a $4 million increase from the net impact of acquisitions and divestitures, partially offset by a $14 million decrease due to changes in FX rates.

Solutions segments revenues were $576 million in the first quarter of 2022, an increase of $74 million, or 15%. The increase reflects a $64 million, or 13%, positive impact from organic growth and a $18 million, or 4%, increase from the inclusion of revenues from the acquisition of Verafin, partially offset by a $8 million decrease from the impact of changes in FX rates.

Market Services net revenues were $315 million in the first quarter of 2022, a decrease of $19 million, or 6%, compared to record revenues in the prior year period. The decrease reflects a $13 million, or 4%, organic decline and a $6 million decrease from the impact of changes in FX rates.

The company repurchased $467 million in shares of its common stock in the first quarter of 2022, including the impact of the $325 million accelerated share repurchase agreement previously disclosed and executed in the first quarter of 2022. As of March 31, 2022, there was $459 million remaining under the board authorized share repurchase program.

The company is announcing an 11% increase in the dividend, to $0.60 per share. The company also began the process of obtaining certain shareholder and SEC approvals to facilitate a 3-for-1 stock split in the form of a stock dividend. If such approvals are received, Nasdaq expects the split to be completed in the third quarter of 2022.