CME Group registers rise in net income in Q4 2021

International derivatives marketplace CME Group Inc. (NASDAQ:CME) today reported financial results for the fourth quarter and full year of 2021.

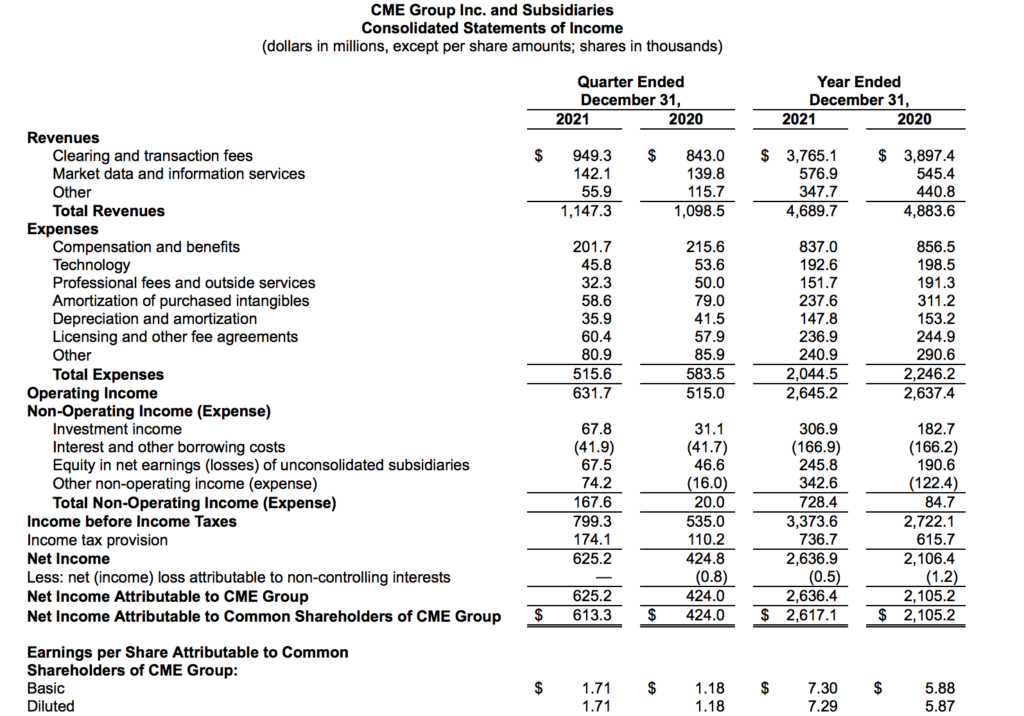

The company reported revenue of $1.1 billion and operating income of $632 million for the fourth quarter of 2021. The result was slightly better than a year earlier.

Net income for the fourth quarter of 2021 was $625 million, up from $425 million registered in the corresponding period a year earlier. Diluted earnings per common share were $1.71.

On an adjusted basis, net income was $608 million and diluted earnings per common share were $1.66.

Total revenue for full-year 2021 was $4.7 billion and operating income was $2.6 billion. Net income was $2.6 billion and diluted earnings per common share were $7.29. On an adjusted basis, net income was $2.4 billion, and diluted earnings per common share were $6.67.

CME Group Chairman and Chief Executive Officer Terry Duffy, commented:

“We achieved record trading volume in 2021, driven by client demand for tools to hedge against continued economic uncertainty across markets. We delivered strong performance across core benchmarks, new products and international business during 2021.

Additionally, we announced a 10-year strategic partnership with Google Cloud to transform global derivatives markets through cloud adoption, and introduced several innovative, new micro-sized and ESG-focused products and services.

We are pleased 2022 is off to a strong start with our highest January average daily volume on record of 24.6 million contracts, led by strong equity index and interest rate volumes, including numerous SOFR futures and options records, and 10% year-over-year growth in overall open interest. Moving ahead, we will continue to focus on providing the risk management tools our clients need to navigate ongoing uncertainties around the world.”

Fourth-quarter 2021 average daily volume (ADV) was 20.5 million contracts, up 26% versus fourth-quarter 2020. Non-U.S. ADV for full-year 2021 reached a record 5.5 million contracts, up 4% compared with the same period in 2020.

Clearing and transaction fees revenue for fourth-quarter 2021 totaled $949 million. The total average rate per contract was $0.650. Market data revenue totaled $142 million for fourth-quarter 2021.

As of December 31, 2021, the company had approximately $2.9 billion in cash (including $100 million deposited with Fixed Income Clearing Corporation (FICC) and included in other current assets) and $3.4 billion of debt.

The company declared dividends during 2021 of $2.5 billion, including the annual variable dividend of $1.2 billion. The company has returned over $17.5 billion to shareholders in the form of dividends since the implementation of the variable dividend policy in early 2012.