Cboe registers 6% Y/Y increase in global FX net revenue in Q3 2023

Cboe Global Markets, Inc. today reported financial results for the third quarter of 2023.

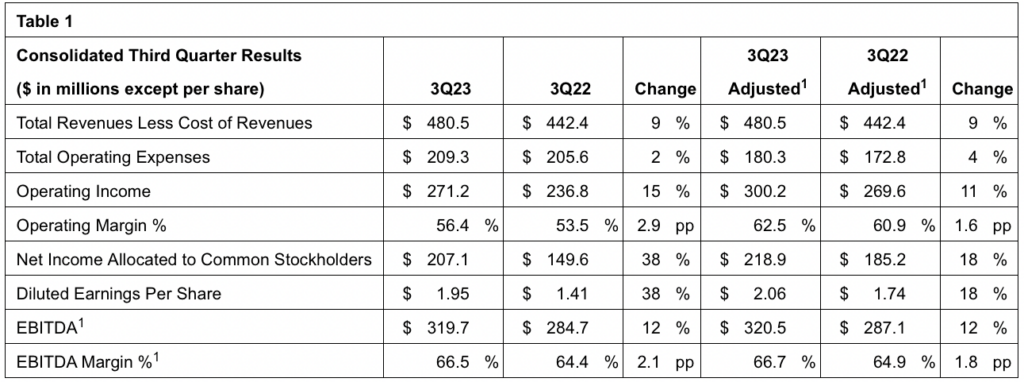

Total revenues less cost of revenues of $480.5 million increased 9%, compared to $442.4 million in the prior-year period, reflecting increases in derivatives markets and data and access solutions net revenue, partially offset by a decrease in cash and spot markets net revenue.

Global FX net revenue of $18.3 million increased 6%, primarily due to higher net transaction and clearing fees.

ADNV traded on the Cboe FX platform was $44.4 billion for the quarter, up 8% compared to last year’s third quarter, and net capture per one million dollars traded was $2.64 for the quarter, down 2 percent compared to $2.69 in the third quarter of 2022.

Cboe FX market share was 20.2 percent for the quarter compared to 17.8 percent in last year’s third quarter, which sets a quarterly record for Cboe FX. The record was driven by new client growth and increased adoption of Cboe’s diverse set of FX order types and trading protocols.

Options net revenue of $290.8 million was up $35.3 million, or 14 percent, from the third quarter of 2022. Net transaction and clearing fees increased primarily as a result of a 28 percent increase in index options trading volumes versus the third quarter of 2022. Access and capacity fees were 5 percent higher than third quarter 2022 and market data fees were 19 percent higher than third quarter 2022.

Futures net revenue of $32.4 million increased $4.0 million compared to the third quarter of 2022, due to double-digit increases in net transaction and clearing fees, access and capacity fees, and market data fees.

Total operating expenses were $209.3 million versus $205.6 million in the third quarter of 2022, an increase of $3.7 million. Adjusted operating expenses of $180.3 million increased 4 percent compared to $172.8 million in the third quarter of 2022. These increases were primarily due to higher technology support services, professional fees and outside services, and travel and promotional expenses, partially offset by a decline in compensation and benefits primarily due to a $9.5 million benefit from executive changes.

Diluted EPS for the third quarter of 2023 increased 38 percent to $1.95 compared to the third quarter of 2022. Adjusted diluted EPS of $2.06 increased 18 percent compared to 2022’s third quarter results.

The company paid cash dividends of $58.5 million, or $0.55 per share, and there were no share repurchases in the third quarter of 2023. As of September 30, 2023, the company had approximately $139.8 million of availability remaining under its existing share repurchase authorizations.

As announced on October 26, 2023, the company’s Board of Directors increased its share repurchase authorization by $250 million. This new authorization will be in addition to any unused amount remaining under the company’s existing share repurchase authorizations. As of October 31, 2023, the company had approximately $389.8 million authorized and available for repurchase.