Cboe registers 12% Y/Y increase in global FX revenues in Q4 2023

Cboe Global Markets, Inc. today reported financial results for the fourth quarter of 2023 and full year.

Global FX net revenue of $18.9 million increased 12% from the year-ago quarter, primarily due to higher net transaction and clearing fees.

ADNV traded on the Cboe FX platform was $47.0 billion for the fourth quarter of 2023, up 15% compared to last year’s fourth quarter, and net capture rate per one million dollars traded was $2.60 for the quarter, down 3% compared to $2.69 in the fourth quarter of 2022.

Cboe FX market share was 21.3% for the quarter compared to 18.4% in last year’s fourth quarter, which set a quarterly record for Cboe FX. The record was driven by new client growth and increased adoption of our diverse set of FX order types and trading protocols.

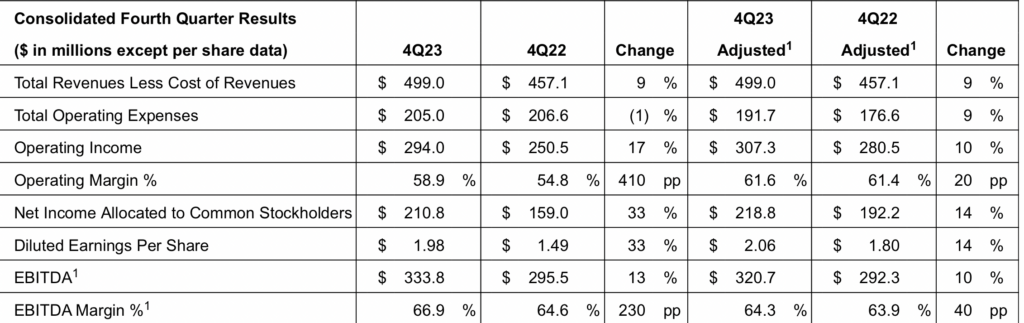

Total revenues less cost of revenues of $499.0 million increased 9%, compared to $457.1 million in the prior-year period, reflecting increases in derivatives markets and data and access solutions net revenue, partially offset by a decrease in cash and spot markets net revenue.

Total operating expenses were $205.0 million versus $206.6 million in the fourth quarter of 2022, a decrease of $1.6 million. Adjusted operating expenses of $191.7 million increased 9 percent compared to $176.6 million in the fourth quarter of 2022. This increase was primarily due to higher compensation and benefits and technology support services, partially offset by a decline in other expenses, depreciation and amortization, and professional fees and outside services.

Diluted EPS for the fourth quarter of 2023 increased 33% to $1.98 compared to the fourth quarter of 2022. Adjusted diluted EPS of $2.06 increased 14% compared to 2022’s fourth quarter results.

“I am pleased to report that Cboe generated another year of strong revenue growth and financial results in 2023,” said Fredric Tomczyk, Cboe Global Markets Chief Executive Officer. “Our Derivatives and Data and Access Solutions categories helped drive the 10% net revenue growth and 13% adjusted diluted EPS growth for the year as both strong secular and cyclical trends helped boost these business lines. In addition, we made meaningful progress on our strategic initiatives as a company and are well-positioned for 2024. This year we plan to unlock additional value from our global derivatives and securities network by leveraging our core strengths – our global footprint, superior technology and product innovation – to help drive continued strong revenue growth and financial results.”