NAGA Group reports record trading volumes in January 2021

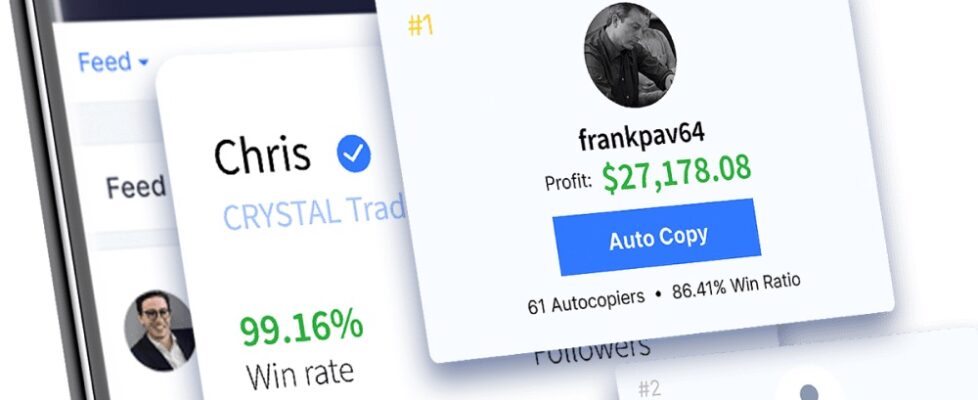

Social trading focused NAGA Group AG (FRA:N4G) has announced that the company continued its strong growth trajectory from 2020, seeing record monthly trading volumes in January 2021.

NAGA stated that clients traded a total of €18.5 billion in January (USD $22 billion), a new monthly record for the company, representing an increase of 216% compared to the same period last year (€5.8 billion). NAGA’s monthly trading volumes during Q4 2020 averaged about $16 billion.

The company said that the number of real money transactions also more than doubled, climbing sharply to a new high of 765,000 (January 2020: 281,000). This also had a positive impact on trading results, which increased by over 246% year-on-year.

NAGA recorded an even more significant increase in new registrations, which rose more than six-fold. Over 25,500 new customers signed up with NAGA in January 2021 (January 2020: 3,900). New deposits have improved over 244% compared to the same period. Likewise, the company recorded a huge demand in the area of cryptocurrency CFDs offered and seven-digit deposits of physical crypto assets to the NAGA Wallet.

The company noted that the already high interest in the stock market is currently further fueled by the ongoing momentum in the cryptocurrency market, as well as the recent global discussions around the GameStop stock short squeeze, sparked by the Reddit forum group.

Benjamin Bilski, CEO and founder of NAGA commented:

Benjamin Bilski, CEO and founder of NAGA commented:

“We are pleased with the strong start in 2021, January significantly exceeded our expectations. At the same time, we see ourselves confirmed in our decision to invest more in marketing. Our growth is profitable and builds on an absolutely sustainable trend in the market.

“We are just about to enter a new era in the stock market. More and more people are interested in the financial market and are actively looking for digital offers for investing in the financial market and cryptocurrencies. NAGA’s social trading platform absolutely hits the nerve of the times. We are very pleased to see that engagement rates are also increasing tenfold on our platform, more and more exchanges are taking place and new users are already used to the combination of “social media & investing” by default. The next months and years on the global stock market will be extremely exciting.”

Hamburg based, CySEC licensed NAGA was the best performing publicly traded Retail FX broker in 2020, with its stock trading up more than six-fold. This morning’s announcement sent the company’s shares up another 13%, to a 52 week high of €4.60.

NAGA Group one year share price chart. Source: Google Finance.