Euronext registers 11.7% Y/Y drop in FX trading revenue in Q1 2023

Pan-European market infrastructure Euronext today published its results for the first quarter of 2023.

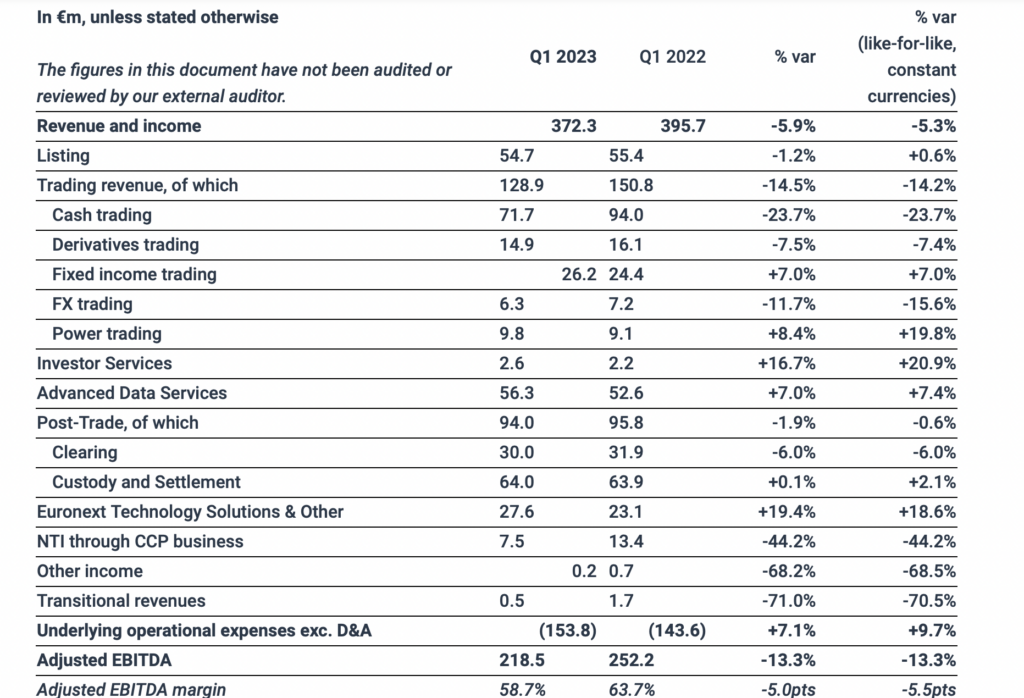

FX trading reported €6.3 million of revenue in the first quarter of 2023, down 11.7% from the first quarter of 2022, which was the second most active quarter for FX trading in Euronext’s history.

Over the first quarter of 2023, Forex average daily volumes of USD21.0 billion were recorded, down 14.4% compared to Q1 2022.

On a like-for-like basis at constant currencies, FX trading revenue was down 15.6% in Q1 2023 compared to Q1 2022.

Derivatives trading revenue decreased by 7.5% to €14.9 million in Q1 2023, compared to a particularly volatile Q1 2022.

Clearing revenue was down 6.0% to €30.0 million in Q1 2023, as a result of weaker cash equity and derivatives clearing activity, partly offset by stronger bond clearing volumes. Non-volume related clearing revenue (including membership fees, treasury income received from LCH SA) accounted for €22.3 million of the total clearing revenue in Q1 2023.

Revenue from Custody, Settlement and other Post-Trade activities, including the activities of Euronext Securities (Copenhagen, Milan, Oslo, Porto), was €64.0 million in Q1 2023, stable compared to Q1 2022, reflecting a new fee scheme and the continued recovery in the value of assets under custody offsetting slightly lower settlement activities.

In Q1 2023, Euronext consolidated revenue and income amounted to €372.3 million, down 5.9% compared to Q1 2022, mainly due to the strong comparison base for equity-related trading and FX rate variation effects, partially offset by the robust performance of non-volume related activities and better performance of fixed income and power trading activities.

Adjusted EBITDA for the quarter totalled €218.5 million, down 13.3% compared to Q1 2022. This represents an adjusted EBITDA margin of 58.7%, down 5.0 points compared to Q1 2022 due to the decrease in volume-related revenue, which was partly offset by resilient non-trading related revenue and continued cost discipline.

Depreciation and amortisation accounted for €40.5 million in Q1 2023, stable compared to Q1 2022. PPA related to acquired businesses accounted for €20.5 million.

Adjusted operating profit was €200.9 million, a 14.0% decrease compared to Q1 2022.

Results from equity investments amounted to €8.4 million in Q1 2023, representing the contribution received from LCH SA, in which Euronext currently owns an 11.1% stake, and a dividend received from Sicovam.

The reported net income, share of the parent company shareholders, decreased by 32.9% for Q1 2023 compared to Q1 2022, to €96.5 million, including the one-off expense related to the termination of the derivatives clearing agreement with LCH SA.

This represents a reported EPS of €0.90 basic and €0.90 fully diluted in Q1 2023, compared to €1.35 basic and €1.35 fully diluted in Q1 2022. The weighted number of shares used over Q1 2023 was 106,726,832 for the basic calculation and 106,991,437 for the fully diluted calculation.

In Q1 2023, Euronext reported a net cash flow from operating activities of €318.2 million, compared to €368.6 million in Q1 2022, reflecting the lower profit before tax. Excluding the impact on working capital from Euronext Clearing and Nord Pool CCP activities, net cash flow from operating activities accounted for 86.5% of EBITDA in Q1 2023.

Stéphane Boujnah, Chief Executive Officer and Chairman of the Managing Board of Euronext, said:

“The migration of Italian cash and ETF markets to our Optiq® trading platform on 27 March 2023 was a tremendous success and brought immediate benefits to Euronext trading members. This major step in the Borsa Italiana Group integration unlocked an additional €9.7 million of run-rate synergies for the quarter, to reach €43.7 million of cumulated run-rate synergies at the end of Q1 2023. Furthermore, the migration reinforced Euronext’s position as the venue for price formation and the leading listing venue in Europe. It demonstrated Euronext’s readiness for the remaining trading and clearing migrations to come.

Going forward, we reiterate for 2023 our floor of above 63% of cash equity market share on average, and a cash trading revenue capture of around 0.52bps following the Borsa Italiana markets migration to Optiq®. Our pan-European project will also be further reinforced by the launch of a series of innovative equity trading solutions, for the benefit of institutional and retail investors.

In addition, the European expansion of Euronext Clearing, starting with equities from Q4 2023, will enable us to accelerate innovation capabilities across businesses, while creating important efficiencies for clients. The upcoming milestones will enable us to create the only pan-European market infrastructure present on the entire value chain and support our ambition to shape capital markets for future generations.”