How major FX and CFD brokers adapt to IBOR transition

FX News Group reviews how some of the world’s major Forex and CFD brokers adapt to IBOR transition.

ThinkMarkets is a Retail FX and CFDs broker established as ThinkForex in 2010 by brothers Nauman and Faizan Anees in New Zealand. The company relocated its headquarters to Australia upon obtaining ASIC regulation in 2012. ThinkForex rebranded as ThinkMarkets in 2016. The company has dual headquarters in Melbourne and London, where ThinkMarkets set up its FCA-licensed subsidiary TF Global Markets (UK) Limited in 2015. The firm also has a licensed subsidiary in South Africa, established in 2019. ThinkMarkets offers trading on its proprietary ThinkTrader platform, as well as MT4 and MT5.

ThinkMarkets is doing about $75 million in annual revenues. The company is currently reportedly considering an IPO.

FX News Group reviews how some of the world’s major Forex and CFD brokers adapt to IBOR transition.

As of 13 December 2021, ThinkMarkets is changing the interbank benchmark rate used to calculate overnight interest.

Tim Rudland had been with FXCM’s institutional arm FXCM Pro for the past two years, serving as VP Institutional Sales.

The change will affect all ThinkMarkets clients using older Desktop or Mobile terminals below the 1320 platform build.

ThinkMarkets UK recently established an institutional services and liquidity arm called Liquidity.net under its FCA license.

ThinkMarkets branches into liquidity provision with a brand-new multi-asset offering via its prime broker partnerships.

Rob Collins joins Valutrades from ThinkMarkets in London, where he was Head Of Trading (UK).

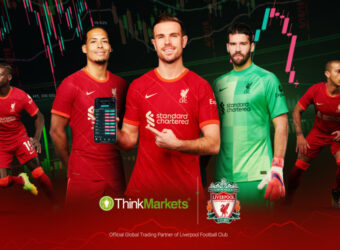

Liverpool FC has welcomed global online trading broker, ThinkMarkets, as its new Official Global Trading Partner.

ThinkMarkets agree to the stay of all discovery pending the Court’s ruling on Sorenson’s Motion to Dismiss.

Online trading company ThinkMarkets makes Platinum available for spot trading as XPT/USD.