StoneX Digital obtains MiCA authorisation

StoneX Digital, a division of StoneX, has secured its Crypto-Asset Service Provider (CASP) licence under the European Union’s MiCA.

StoneX Digital, a division of StoneX, has secured its Crypto-Asset Service Provider (CASP) licence under the European Union’s MiCA.

CASPs operating under national rules may continue providing services until 1 July 2026, CySEC says.

MiCAR authorization enables Nuvei to deliver regulated crypto-asset services and passport them across the European Union.

Today Blockchain.com announced the company received its MiCA (Markets in Crypto-Assets) license.

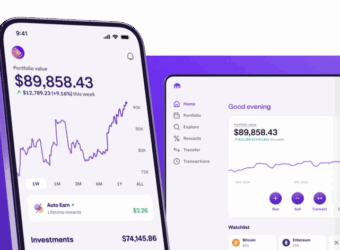

Lines are becoming increasingly blurred between neobanks like Revolut, crypto exchanges platforms, and CFDs brokers.

BitGo Europe now offers European investors a comprehensive suite of crypto custody, staking, transfer, and crypto trading services.

All EEA clients are now directly served by Kraken’s MiCA-regulated entity, authorized by the Central Bank of Ireland.

CoinShares International’s French subsidiary, CoinShares Asset Management, has received authorisation under the Markets in Crypto-Assets (MiCA) Regulation.

Coinbase has secured its Markets in Crypto Assets (MiCA) licence from the Luxembourg Commission de Surveillance du Secteur Financier (CSSF).

Binance is making changes to the availability of Stablecoins that are not compliant with MiCA in the EEA.