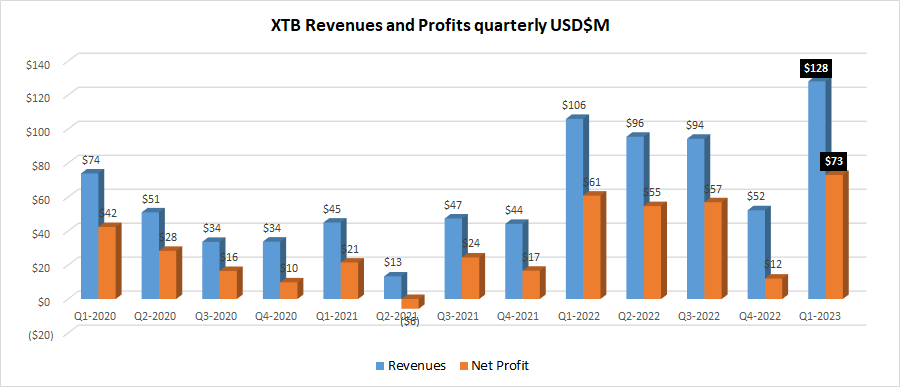

XTB posts record Revenues ($128M) and Profit ($73M) in Q1-2023

Poland based online broker XTB SA (WSE:XTB) has reported its financial results for the first quarter of 2023, and they are indeed impressive. XTB reported record quarterly results on both the top and bottom line, driven by a record number of new clients acquired by XTB.

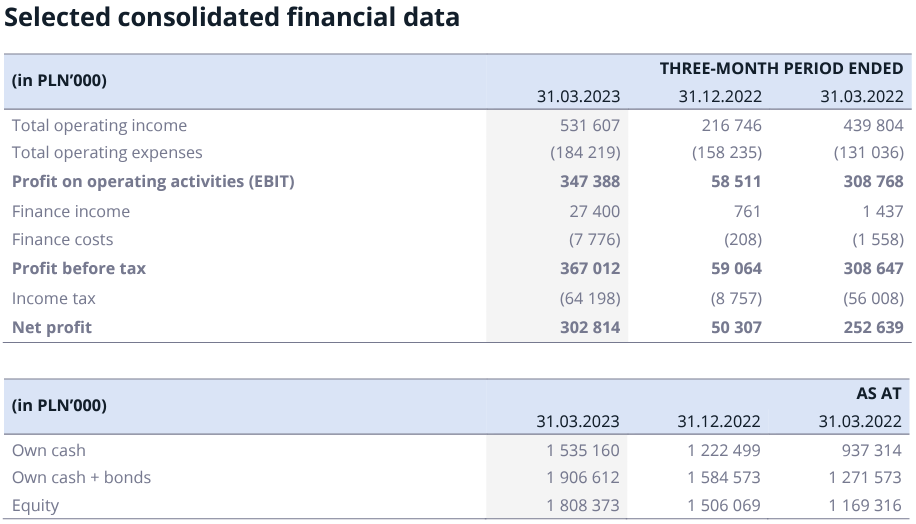

On the top line, XTB posted Revenues of PLN 531.6 million (USD $128 million) in Q1, well surpassing XTB’s best-ever quarter previously of $106 million in Q1-2022. It also marked a 145% increase in Revenues from last quarter, Q4-2022.

Profit-wise XTB earned PLN 302.8 million (USD $73 million) in Net Profit in Q1-2023, topping the $61 million profit XTB reported in Q1-2022.

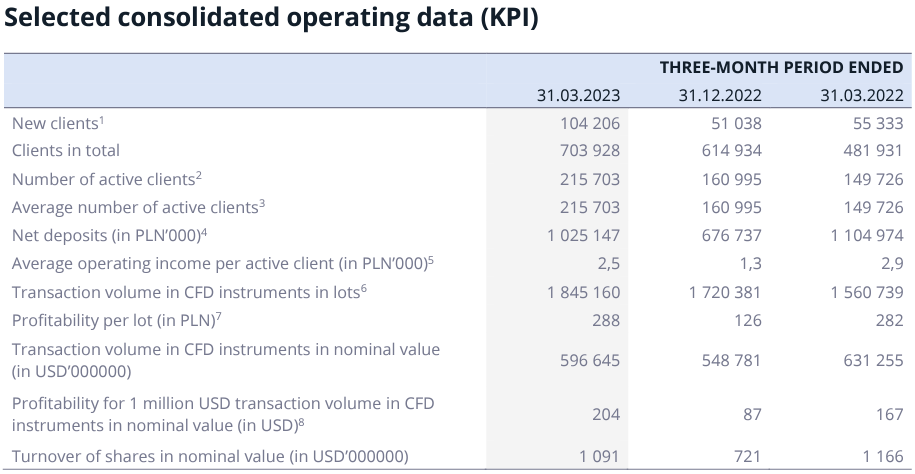

XTB’s trading volumes in Q1 2023 averaged $199 billion monthly, up slightly from the $188 billion that XTB averaged in 2022 – meaning that Q1-2023 saw a nice leap in profitability-per-volume-traded in what was a very volatile Q1 in the financial markets.

The first quarter of 2023 was another period of dynamic business development and building a client base for XTB. The group acquired a record 104.2 thousand new clients, an increase of 88.3% y/y, while the number of active clients increased by 44.1% y/y from 149.7 thousand to 215.7 thousand. This also contributed to the increase in the trading volume of clients on CFD instruments expressed in lots – an increase from 1.6 million to 1.8 million, i.e. 18.2% y/y.

In September 2022, promotional activities were launched with the participation of Conor McGregor, another XTB brand ambassador – Irish mixed martial arts (MMA) and the UFC fighter. Conor McGregor is the biggest martial arts star in the world and the best rewarded athlete according to Forbes list. Conor is not only a fighter, but also a successful person in business as an investor in many interesting projects.

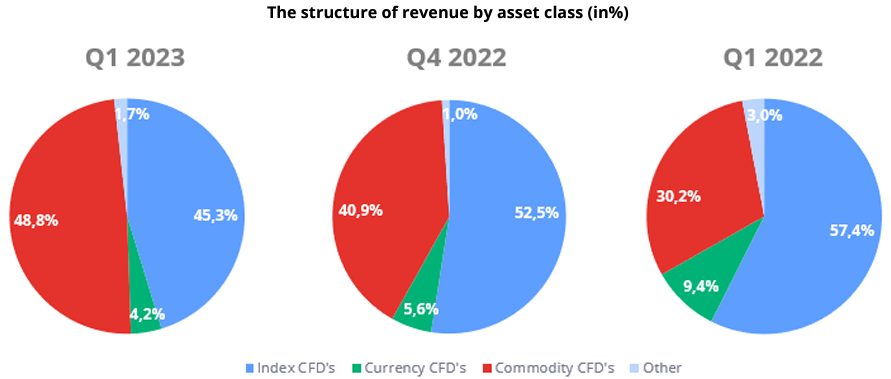

Looking at XTB’s revenues in terms of the classes of instruments responsible for their creation, it can be seen that in the first quarter of 2023 CFDs based on commodities. Their share in the structure of revenues on financial instruments reached 48.8% compared to 30.2% a year earlier. The most profitable instruments in this class were CFDs instruments based on quotations of natural gas and gold. The second most profitable asset class was CFD based on index. Their share in the revenue structure in the first quarter of 2023 was 45.3% (Q1 2022: 57.4%). The most profitable instruments in this class were CFDs instruments based on the German DAX index (DE30), the US 100 index and the US 500 index. Revenues on CFDs based on currencies accounted for 4.2% of all revenues compared to 9.4% year earlier, where the most profitable instruments in this class were CFDs on currency pairs EURUSD.

XTB said that with its strong market position and dynamically growing client base builds its presence in the non-European markets, consequently implementing a strategy on building a global brand. The XTB Management Board puts the main emphasis on organic development, on the one hand increasing the penetration of European markets, on the other hand successively building its presence in Latin America, Asia and Africa.

Following these activities, the composition of the capital group may be expanded by new subsidiaries. It is worth mentioning that geographic expansion is a process carried out by XTB on a continuous basis, the effects of which are spread over time. Therefore, one should not expect sudden, abrupt changes in the group results on this action.

The development of XTB is also possible through mergers and acquisitions, especially with entities that would allow the Group to achieve geographic synergy (complementary markets). Such transactions will be carried out, only when they will bring measurable benefits for the Company and its shareholders. Currently, the Management Board’s efforts are focused on reaching mass clients with the offer. This is crucial for further dynamic development of XTB and building a global brand. This goal is to be served by new products added to the offer in 2023 and in the consecutive years.

The Management Board estimates that the effects of these works will give a much higher output than if the available resources were invested in launching operations in South Africa. For this reason, the start of operations of XTB Africa (PTY) Ltd. has been postponed at least until 2024.

XTB’s full financial report for Q1 2023 can be seen here (pdf).