Swissquote sees record Revenue and Profit in 2H-2023, acquires Optimatrade

Leading Switzerland based online banking and trading provider Swissquote (SWX:SQN) has released its final financial figures for 2023, confirming a strong year 2023 with Revenues, Profits and client assets at record levels, while heading to 2024 with positive momentum.

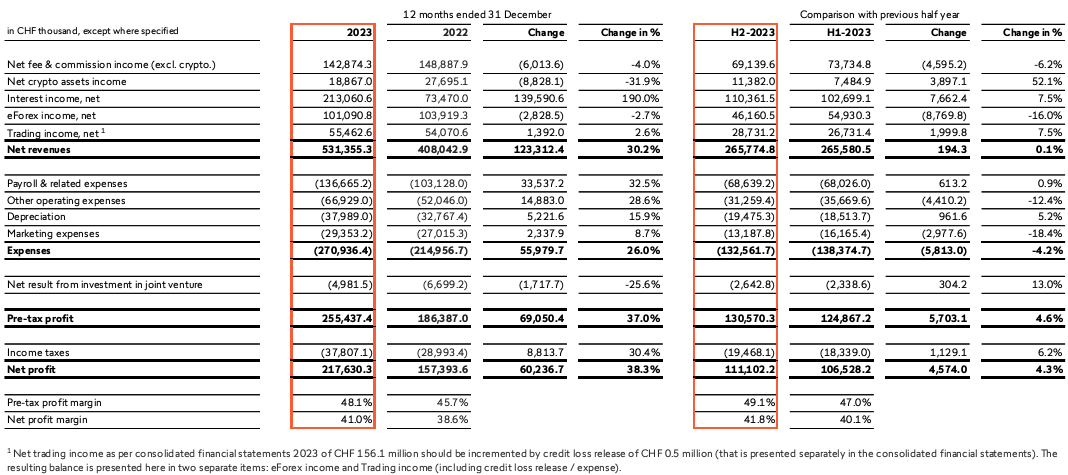

Swissquote said that despite a challenging environment, the company achieved stronger results than ever with net revenues of CHF 531.4 million (USD $604 million), a pre-tax profit of CHF 255.4 million and client assets reaching CHF 58.0 billion in 2023. During this period, Swissquote diversified its revenue streams not only by expanding beyond transaction-based earnings, but also by growing its revenues from international clients in Europe, Asia and the Middle East.

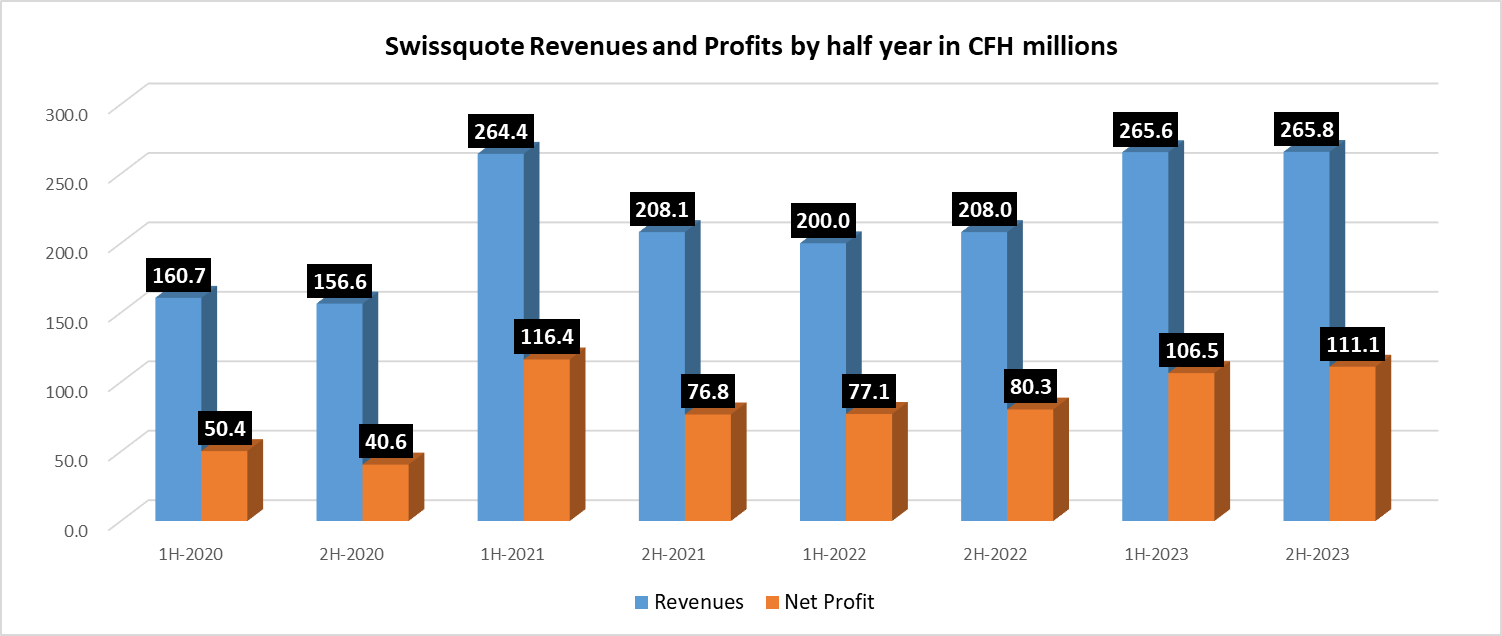

Both Revenues and Profits at Swissquote increased slightly in the second half of the year from 1H-2023 levels.

For the first time, non-transaction-based revenues (58%) at Swissquote exceeded transaction-based revenues (42%) and internationally located customers represented a bigger share of net revenues than Swiss residents (51% and 49%, respectively).

eForex trading volumes at Swissquote averaged $123 billion monthly in 2023, up by 5% from 2022.

Looking ahead, Swissquote said it expects to continue to grow in 2024, and is confirming its pre-tax profit target for 2025 (CHF 350 million). The Board of Directors is proposing a dividend of CHF 4.30 per share.

Growth led by revenue diversification

In 2023, net revenues reached CHF 531.4 million, an increase of 30.2% compared to the previous year (CHF 408.0 million). This favourable development was mainly supported by continued growth in net interest income (CHF 213.1 million), as a result of higher interest rates on all major currencies and resilient cash deposits (15% of total client assets). Net fee and commission income decreased by 4.0%, reflecting a low level of customer activity.

Net crypto assets income decreased by 31.9%. 2023 was generally a year of low volatility for the crypto market, particularly in the first nine months. Crypto assets volatility improved in the last part of 2023, mainly driven by excitement around better conditions in 2024.

Net eForex income decreased by 2.7% in 2023. Even though both eForex assets and volumes grew in comparison to the previous year, the low volatility, which dominated FX markets, affected the profitability of the eForex volumes. Net trading income increased by 2.6%, supported by the development of new products and services (e.g. debit cards and payments).

Improved pre-tax margin at 48.1%

At CHF 270.9 million, total expenses increased by 26.0% mainly due to increased payroll & related expenses and other operating expenses. As of 31 December 2023, the total headcount was up by 78 to 1,134 FTE (+7.4%), due primarily to hiring in the field of technology and at the level of foreign offices. In 2023, the pre-tax profit increased by 37.0% to a new record level of CHF 255.4 million (CHF 186.4 million). The pre-tax profit margin grew to 48.1% (45.7%), while the net profit increased to CHF 217.6 million (CHF 157.4 million), with the net profit margin rising to 41.0% (38.6%).

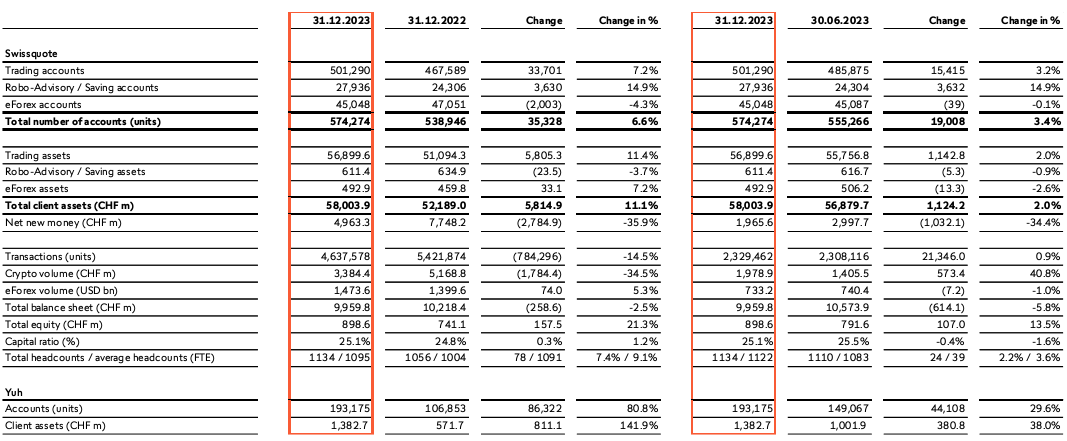

Trading accounts grew by +7.2% in 12 months

A total of 574,274 client accounts was reached at the end of 2023, a net increase of 35,328 accounts or 6.6%. The number of Trading accounts grew by 7.2% in the last 12 months, reflecting intact customer interest in a year of rising interest rates. The implementation of more accessible investment strategies such as “Invest Easy” triggered a solid 14.9% growth in Robo-advisory/Saving accounts. The number of active eForex accounts (inactive eForex accounts are not reported) decreased by 4.3%, but the eForex assets continued to show growth (+7.2%). Overall, total client assets grew by 11.1% to an all-time high of CHF 58.0 billion (CHF 52.2 billion). This positive development results from a net new money inflow of CHF 5.0 billion (CHF 7.7 billion) and a positive market impact. The strength of the Swiss franc affected both client assets and net new monies (translated from foreign currency to CHF for reporting purposes).

Thanks to solid equity position, payout ratio at 30%

As of 31 December 2023, total balance sheet assets amounted to CHF 10.0 billion (CHF 10.2 billion). Bolstered by a combination of solid profitability and cautious balance sheet management, total equity grew by 21.2% to CHF 898.6 million (CHF 741.1 million). The capital ratio increased further to 25.1% (24.8%), well above the regulatory limit of 11.2%. In that context, the Board of Directors strives for a stable dividend policy. The payout ratio to shareholders should generally amount to 30% of the reported net profit, i.e. CHF 4.30 per share for 2023 (+95%).

International presence reinforced – acquisition of Optimatrade

Swissquote is announcing the acquisition of Optimatrade Investment Partners (Pty) Ltd, a company domiciled in Cape Town, South Africa. This company, regulated locally as a financial services provider, has been acting as an introducer for Swissquote for more than ten years. In 2023, the related commission expenses incurred by Swissquote represented approximately 0.4% of net revenues. The transaction will enable natural synergies, in particular when rebranding Optimatrade. The current CEO and founder of Optimatrade, a Swiss national living in South Africa, will pursue his role in the company. The transaction was completed on 1 March 2024. The parties have agreed not to disclose the purchase price.

Yuh mobile app close to 200,000 customers

In 2023, the mobile finance app Yuh, Swissquote’s 50% joint venture, successfully increased the number of accounts from 106,853 to 193,175 (+80.8%) and its client assets from CHF 0.6 billion to CHF 1.4 billion (+141.9%). During 2023, the net pre-tax profit contribution of Yuh was still negative by –CHF 5.0 million (–CHF 6.7 million). In 2024, this contribution is still expected to be negative, but to a lesser extent. Early 2024, the number of Yuh accounts surpassed 200,000.

Further upgrades in non-financial reporting

Swissquote reports further improvements in its non-financial reporting, with new climate-related information under the framework proposed by the Task Force on Climate-related Financial Disclosures (TCFD) and a larger scope of external assurance. In 2023, Swissquote was able to improve its Sustainalytics ESG rating from “medium” to “low” risk, confirming the successful implementation of the various efforts in this field. At this year’s annual General Meeting, the shareholders will for the first time vote on the Sustainability Report, which serves as the report on non-financial matters newly required by the Swiss Code of Obligations.

2024 guidance and 2025 outlook

For 2024, Swissquote is targeting net revenues of CHF 595 million and a pre-tax profit of CHF 300 million. Going forward, interest income will likely be affected by potential policy rate cuts, but Swissquote expects to be protected to a certain extent thanks to its multi-currency balance sheet. Net interest income should grow compared to 2023. At the same time, an upswing in trading optimism was noted in the last quarter of 2023, mostly inspired by signs of slowing inflation and hopes that interest rates had peaked. Getting closer to its medium-term targets set for 2025, Swissquote confirms that the pre-tax profit of CHF 350 million remains the primary objective, which should be achieved with a pre-tax profit margin above 50%.

Swissquote financial and operating summary 2023