Swissquote registers drop in H1 2022 revenues as customers get cautious with trading

Leading Swiss online trading firm Swissquote today reported its financial results for the six months to end-June 2022, with revenues down from the equivalent period a year earlier.

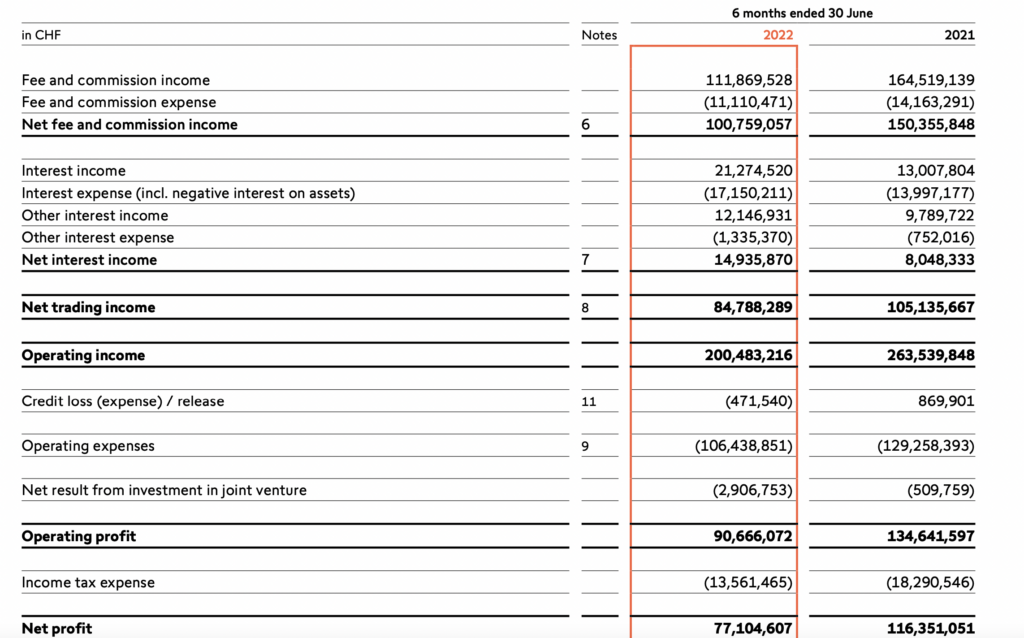

Operating revenues for the first half of 2022 totalled CHF 204.8 million – a decrease of 23.1 percent compared with the previous year (CHF 266.4 million). When adjusted for negative interest rates (CHF 4.1 million) and after fair value adjustments (CHF 0.7 million), net revenues amounted to CHF 200.0 million, down 24.4 percent from CHF 264.4 million in the prior year.

Swissquote notes that, in the first half 2022, customers were more cautious with trading but stayed invested, even in higher-risk asset classes such as crypto assets (e.g. crypto holdings have increased in major crypto assets).

Compared with the prior-year period, net fee and commission income declined by 6.7 percent to CHF 81.3 million (CHF 87.1 million). While moving from a rally in the first half of 2021 to a sharp slump in the first half of 2022, net crypto-assets income dipped by 69.2 percent to CHF 19.5 million (CHF 63.2 million).

Net trading income dropped by 28.0 percent to CHF 30.7 million (CHF 42.6 million) and net eForex income declined by 13.7 percent to CHF 54.3 million (CHF 63.0 million).

At CHF 106.4 million, operating expenses were 17.7 percent lower than in the previous year (CHF 129.3 million). While Swissquote continued to pursue its growth strategy, more attention was focused on the management of expenses. As of 30 June 2022, the headcount was up by 88 FTE (of which 14 FTE inorganic) to a total of 1,040 FTE. The vast majority of the new employees have been sourced in the technology sector.

Pre-tax profit decreased by 32.7 percent to CHF 90.7 million (CHF 134.6 million), while the pre-tax profit margin was still solid at 45.3 percent (50.9 percent). At CHF 77.1 million (CHF 116.4 million), net profit was down 33.7 percent year-on-year, with a net profit margin of 38.6 percent (44.0 percent).

Despite the dividend distribution and the acquisition of Keytrade Bank Luxembourg, the capital ratio remained high at 25.7 percent (24.3 percent). Total equity increased by 21.9 percent to CHF 663.4 million (CHF 544.0 million).

Thanks to the opening of more than 34,000 new accounts, net new money inflow remained strong and reached CHF 5.0 billion (CHF 4.9 billion). Nevertheless, net new monies were more than cancelled out by the negative market impact of -CHF 9.1 billion (+CHF 5.5 billion). As of 30 June 2022, total crypto assets under custody declined to CHF 1.1 billion (CHF 2.8 billion) despite the fact that customers have increased their holdings in major crypto assets.

By the end of September 2022, Swissquote will roll out its own crypto exchange. This project represents a substantial transformation of the existing crypto trading technology. Swissquote will operate its own centralised order book, allowing customers to trade with each other. Security remains a key concern for investors and regulatory scrutiny is likely to increase in the crypto in- dustry. In that context Swissquote aims to position itself as a partner of choice for private and institutional clients.

As of today, the Yuh mobile app already counts 75,000 “Yuhsers”. During the first half, Yuh continued to add many important features such as Apple/Google Pay, recurring investments, savings plans and standing orders. Later in the year, Yuh should launch e-billing and a comprehensive offering for Pillar 3a savings.

As of 29 April 2022, Swissquote completed the acquisition of Keytrade Bank Luxembourg and integrated approx. 8,000 customers and CHF 1.7 billion in client assets. Thanks to this transaction, Swissquote has reinforced its local footprint in the Benelux area. Swissquote is ready to contemplate more M&A transactions in the future if they contribute to the pursuit of Swissquote’s ambitious strategy.

Following the recent changes in central banks’ monetary policies, Swissquote expects to benefit from higher benchmark interest rates. For 2022, it anticipates interest income to be 2.5x higher than in 2021. At the same time, Swissquote has either reduced its negative interest rates or waived them altogether for all its clients.

The surrounding uncertainty encourages Swissquote to remain cautious for the time being, in particular with respect to the length of the crypto market downturn.

For the full year 2022, Swissquote expects net revenues to be in the range of CHF 400 – 420 million. On the earnings side, pre-tax profit is expected to be close to CHF 190 million in 2022.