StoneX registers 32% Y/Y drop in FX/CFD revenues in Q1 FY23

StoneX Group Inc. (NASDAQ: SNEX), the owner of retail Forex brands such as FOREX.com and City Index, has announced its financial results for the fiscal year 2023 first quarter ended December 31, 2022.

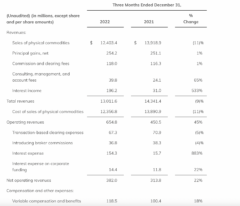

Operating revenues derived from FX/CFD contracts declined $23.4 million, or 32%, to $48.8 million in the three months ended December 31, 2022 compared to $72.2 million in the three months ended December 31, 2021, principally due to a 27% decline in FX/CFD contracts RPM.

Operating revenues derived from OTC derivatives declined $4.2 million, or 9%, to $42.5 million in the three months ended December 31, 2022 compared to $46.7 million in the three months ended December 31, 2021. This was the result of 6% and 2% declines in OTC derivative contract volumes and the average rate per contract, respectively, compared to the three months ended December 31, 2021.

Operating revenues derived from listed derivatives declined $0.8 million, or 1%, to $99.8 million in the three months ended December 31, 2022 compared to $100.6 million in the three months ended December 31, 2021. This decline was principally due to an 11% decline in the average rate per contract, which was partially offset by a 9% increase in listed derivative contract volumes compared to the three months ended December 31, 2021.

Across all segments, operating revenues increased $204.3 million, or 45%, to $654.8 million in the three months ended December 31, 2022 compared to $450.5 million in the three months ended December 31, 2021.

On October 31, 2022, StoneX’s wholly owned subsidiary, StoneX Netherlands B.V., acquired CDI-Societe Cotonniere De Distribution S.A (CDI), based in Switzerland. CDI operates a global cotton merchant business with clients and producers in Brazil and West Africa as well as buyers throughout Asia. The results of the three months ended December 31, 2022 include a non-taxable gain of $23.5 million, as well as amortization expense related to identified intangible assets, related to the acquisition.

The Company acquired GAIN Capital Holdings, Inc. effective August 1, 2020. The results of the three months ended December 31, 2022 and 2021 include amortization expense related to identified intangible assets, related to the acquisition.

Sean M. O’Connor, the Company’s CEO, stated:

“We achieved very strong results in the fiscal first quarter 2023, delivering increases in operating revenues and net income, which resulted in a diluted EPS of $3.62 and an ROE of 27.3% for the quarter. These results included a $23.5 million non-taxable gain on the acquisition of CDI, which contributed $1.11 of earnings per diluted share, and a significant increase in interest income, reflecting the growth in our client assets and the higher interest rate environment.

While trading conditions moderated towards the end of the first quarter, the multiple drivers of our results, including our disciplined approach to acquisitions, the strong growth in client assets and our core operating performance, exemplify the diversity in our operating model. We believe that these multiple drivers and our ongoing investments position us to continue to empower our clients, drive growth and deliver shareholder value.”