Saxo Bank trading volumes soar 30% in March 2021 to $393 billion

Saxo Bank greeted its new Chairman Kari Stadigh with some fairly bullish figures, releasing March 2021 client trading volumes which were some of the best in years for the Copenhagen based Retail FX and CFDs broker.

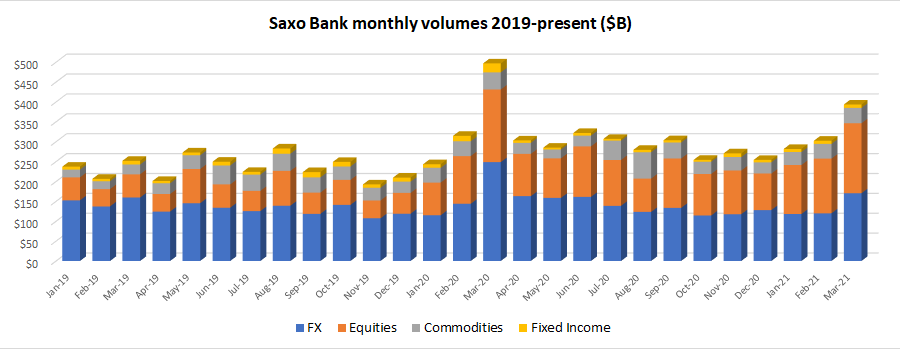

Client trading at Saxo Bank totaled $393.4 billion in March – up 30.1% over February’s $302.4 billion. To put things in some more perspective, $393.4 billion is also 30% above 2020’s average monthly volume of $302.9 billion at Saxo, and represents Saxo’s second best month since mid 2018 – a year in which the firm regularly topped $400 billion in monthly trading – with only last March’s $496.8 billion being better.

All asset categories at Saxo Bank were up in March 2021 – FX at $170.5 billion (+42.3% MoM), Equities $175.8 billion (+27.8%), Commodities $38.8 billion (+5%) and Fixed Income $8.3 billion (+4%).

Saxo Bank is controlled by China’s Geely Group, which bought a majority interest in the company in 2018.