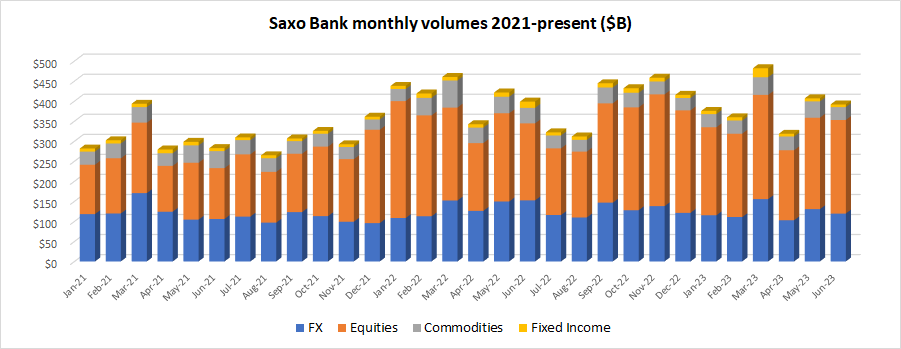

Saxo Bank trading volumes fall 4% in June to close out slow 1H-2023

Copenhagen based Retail FX and CFDs broker Saxo Bank has reported its client trading metrics for June, indicating a 4% MoM drop in overall activity, closing out a relatively slow first-six-months of 2023.

Overall, client trading volumes at Saxo Bank totaled $391.7 billion in June 2023, down by 4% from May’s $407.0 billion. Core FX trading volumes were down by 8% to $119.5 billion, although Saxo had another good month for Equities trading, up 2% MoM to $233.5 billion.

For the first half of 2023 Saxo Bank averaged $389 billion in monthly trading volume, down by 4% from 2022’s monthly average of $405 billion. The decline in activity comes at a sensitive time for the company, with its two major outside shareholders – China’s Geely Group (49.9%) and Finland’s Sampo (19.8%) – looking to monetize their stakes in the company. Saxo had attempted to go public last year via a SPAC merger, but eventually canceled the deal.

Client trading volumes at Saxo Bank in June 2023 were as follows:

- FX trading down 8% MoM to $119.5 billion.

- Equities trading up 2% to $233.5 billion.

- Commodities trading down 21% to $32.1 billion.

- Fixed income trading down 4% to $6.6 billion.