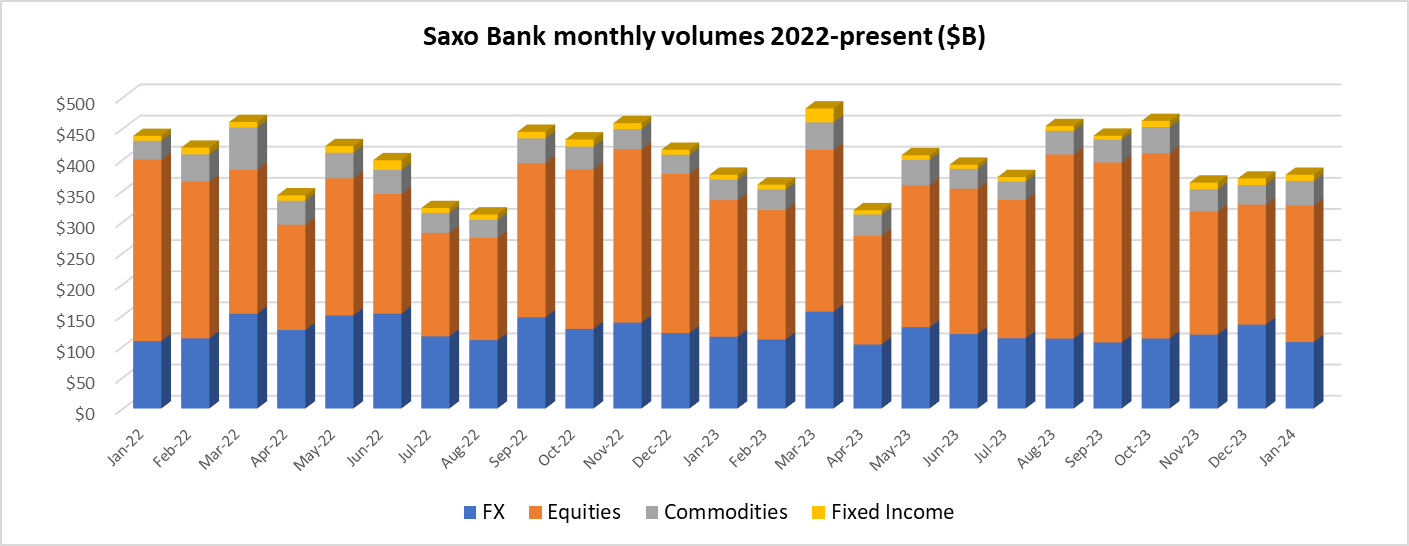

Saxo Bank sees FX trading volumes down, Equities up in slow January 2024

Following a decline in trading volumes over the last two months of 2023, Copenhagen based Retail FX and CFDs broker Saxo Bank saw the slow activity continue into 2024, with January trading volumes totaling $375.5 billion (versus a 2023 monthly average of $399 billion at Saxo).

Volumes at Saxo were up slightly (by 1.6%) from December (a typically slow month), but remained well below the $400 billion+ figures Saxo generated throughout most of mid to late 2023.

Saxo Bank saw a 21% MoM decline in its core FX trading volumes in January, to $106.7 billion, but that was compensated by a 14% increase in Equities trading, to $219.7 billion.

Client trading volumes at Saxo Bank in January 2024 were as follows:

- FX trading down 21% MoM to $106.7 billion.

- Equities up 14% to $219.7 billion.

- Commodities up 24% to $39.3 billion.

- Fixed income trading down 5% to $9.8 billion.

Saxo Bank is controlled by China’s Geely Group.