Saxo Bank rides the trading wave to record 6mo 2020 results

It has been somewhat interesting reading the financial reports of various Retail and Institutional FX and CFD platforms in recent weeks.

If ever the saying “a rising tide lifts all boats” were relevant to mention about the FX industry, the first six months of 2020 would be it. Market volatility was at never-seen-before levels in virtually all traded markets – equities (down 30%+ then back to record highs), commodities (negative oil prices, record gold prices), and of course FX.

And with sports bettors shut down for the better part of three months in 1H 2020 and looking for “action”, the online financial trading sector had the perfect storm for a record setting pace in the first half of 2020.

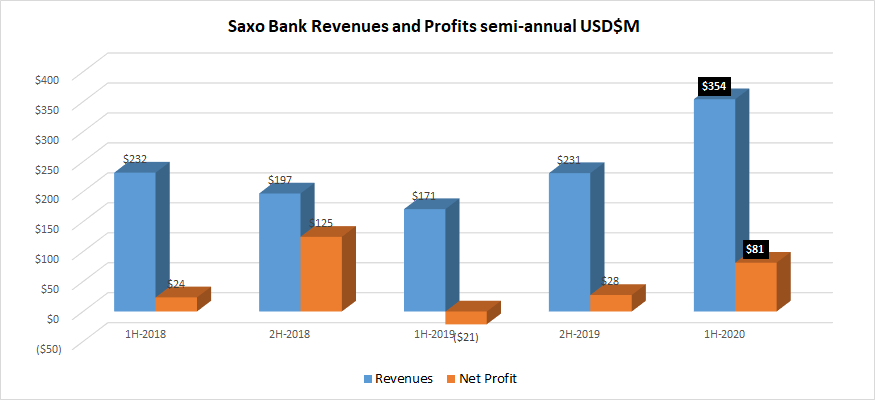

Copenhagen based Saxo Bank was no exception, with the company’s revenues for six-months 2020 nearly topping that of all of 2019. (EBITDA for 1H-2020 did outpace all of 2019). Saxo Bank also reported record net profit, an all time high in client assets, record number of client trades, record number of new clients, as well as record growth in the firm’s equity trading business.

Saxo Bank reported net profit of DKK 529 million (USD $81 million) for the first half of 2020 compared to a net loss of DKK 139 million as of June 2019. Revenue (or what Saxo calls “Operating income”) for the group amounted to DKK 2.3 billion ($354 million) as of June 2020 compared to DKK 1.1 billion as of June 2019, an increase of 107% percent.

In its typical understated way, Saxo Bank called the overall results “very satisfactory”.

Saxo Bank, which employs more than 2,000 people in offices across the globe, said it welcomed record high levels of new clients and a continued inflow of clients’ assets in the first half of 2020. The direct client base grew with more than 80,000 new active clients, bringing the group to a record high total of more than 620,000 clients. Total client assets ended at DKK 395 billion ($61 billion) as of 30 June 2020, up more than 3x from DKK 131 billion as of 30 June 2019.

EBITDA at Saxo Bank was DKK 967 million ($149 million) in 6mo-2020, versus just DKK 57 million in H1 2019 and DKK 822 million for the full year 2019.

As far as outlook for the rest of the year (we’d note that Saxo Bank trading volumes in July were down 5% from June), the company said that it foresees “continued positive growth” in operating income for the remainder of 2020, albeit at a lower level than what it has seen for the first six months. With that in mind and based on the result for first six months of 2020, Saxo Bank said that at this stage it expects to end 2020 with a positive net profit in the range of DKK 600-850 million.

Saxo Bank co-founder and CEO Kim Fournais had the following to say about the company’s results:

The first six months of 2020 have been extraordinary in many ways. COVID-19 has impacted the global community and all the markets we operate in. The human and economic consequences have been immense. As many other organisations, we had to quickly adapt to new ways of working, essentially going from having 17 offices to more than 2,000 “offices”, as Saxonians worked from home – while at the same time welcoming a record high number of new clients and keeping the bank fully operational.

The financial result of the first six months of 2020 is very satisfactory. The result is positively affected by external factors such as the increase in volatility in global capital markets. The result is also driven by the continued execution of our strategy, including the high investments into digitisation, scalable infrastructure, automated processes, and an improved Saxo Experience, leading to a significant growth in number of new clients and client assets. With the financial result for the first half of the year and an even stronger capital position, we are well-positioned to continue our ambitious investments to create an even better Saxo Experience for our current and future clients.

The execution of the strategy has increased Saxo Bank’s relevance to the investor segment which has grown by more than 200 percent and diversified the Group’s revenue streams significantly across client segments and products.

The global trend of more people starting to take ownership of their investments in the financial markets has accelerated over the past 6 months. This comes with an important task for investment providers to support their clients – not only by giving access to the financial markets, but also delivering timely and relevant information as well as tools to help clients make informed investment decisions and manage their risk. We have accelerated our work to support clients through personalised news and alerts, online education, webinars and risk management tools, and we have seen significant uptake in clients’ engagement with this content. I am proud that we continue to deliver on our vision to empower clients to make more informed investment decisions.

Saxo Bank’s full first half 2020 report can be seen here.