Saxo Bank reviews bubble stocks basket

Multi-asset investment specialist Saxo Bank is performing a dramatic cleanup of the bubble stocks basket as former bubble stocks are no longer meeting the criteria. This has led to 26 out of 40 stocks leaving the basket.

The bubble stocks basket was a high-flying basket in the beginning of last year, but the gradually higher interest rates and inflation pressures driven by higher energy prices forced investors to rethink equity portfolios. As a result a rotation process was set in motion which led to bubble stocks (speculative growth stocks) to be shredded in masse while commodity and value related stocks were increased in portfolios.

Saxo introduced its bubble basket on 8 January 2021 and updated its methodology during early February publishing a renewed basket on 12 February 2021 in which it warned of bubble stocks. Since that day almost a year ago, the bubble stocks basket is down 55.2%.

The methodology behind the bubble stocks basket is not changing and thus Saxo is still selecting the 40 largest stocks on market capitalization with the following characteristics:

- Market capitalization above $2bn

- Listed on exchanges in North America, Western Europe, Singapore, Japan, Australia, and Hong Kong

- 12-month forward EV/Sales above 8x

- 12-month forward EPS less than 0

Based on a current screening there are 26 stocks out of 40 stocks leaving the bubble stocks basket:

- Kuaishou Technology

- Sea Ltd

- Airbnb Inc

- NIO Inc

- Snowflake Inc

- DoorDash Inc

- Roku Inc

- Bilibili Inc

- Teladoc Health Inc

- XPeng Inc

- Cloudflare Inc

- Splunk Inc

- Exact Sciences Corp

- Gaotu Techedu Inc

- Farfetch Ltd

- DraftKings Inc

- GDS Holdings Ltd

- Ping An Healthcare and Technology Co Ltd

- Innovent Biologics Inc

- Zai Lab Ltd

- Kingsoft Cloud Holdings Ltd

- Yatsen Holding Ltd

- Oak Street Health Inc

- C3.ai Inc

- Canopy Growth Corp

- Appian Corp

Many of these companies still have market capitalization above $2bn and negative earnings expectations, but they have fallen a lot over the past year combined with revenue growing such that their 12-month forward EV/Sales ratio has gone below 8x.

The 26 new stocks entering the basket are:

- Rivian Automotive Inc

- Lucid Group Inc

- NU Holdings Ltd/Cayman Islands

- Cellnex Telecom SA

- Okta Inc

- SenseTime Group Inc

- Grab Holdings Ltd

- Confluent Inc

- Qualtrics International Inc

- Brookfield Renewable Corp

- SentinelOne Inc

- Robinhood Markets Inc

- Samsara Inc

- Gitlab Inc

- Asana Inc

- Monday.com Ltd

- Biohaven Pharmaceutical Holding Co Ltd

- Procore Technologies Inc

- Kingdee International Software Group Co Ltd

- Guidewire Software Inc

- Ginkgo Bioworks Holdings Inc

- Smartsheet Inc

- Novocure Ltd

- Shanghai Junshi Biosciences Co Ltd

- Ascendis Pharma A/S

- Intellia Therapeutics Inc

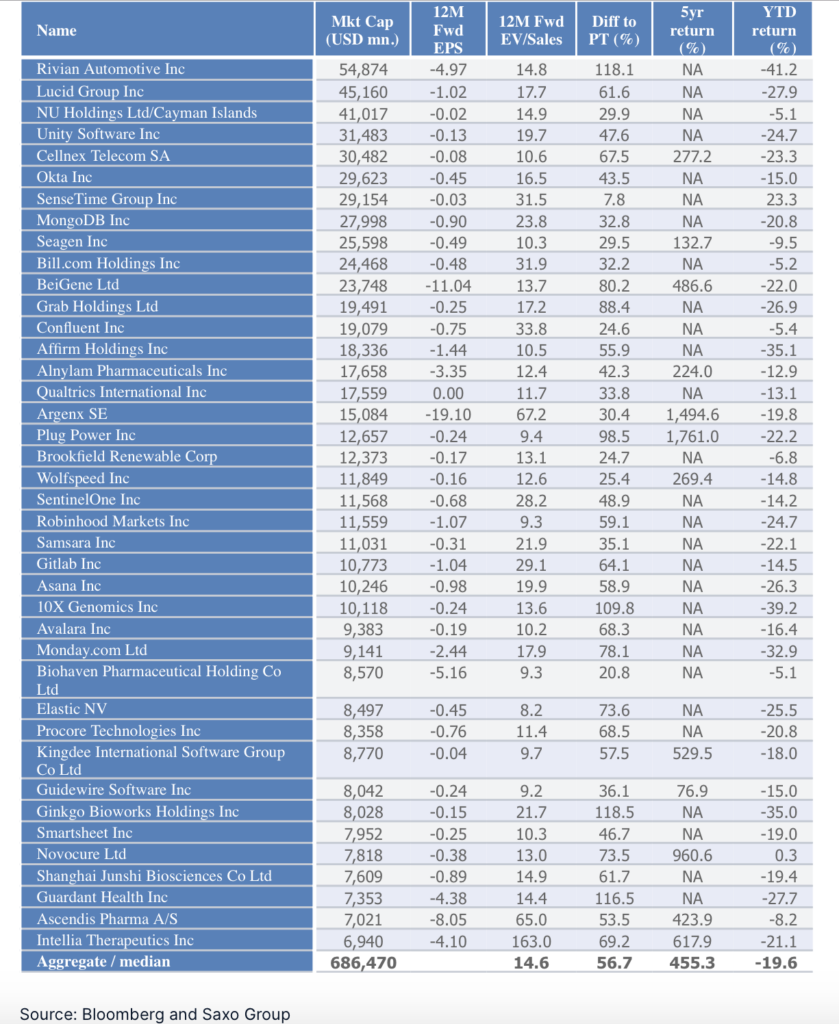

The table below shows the new updated bubble stocks basket and some key statistics.