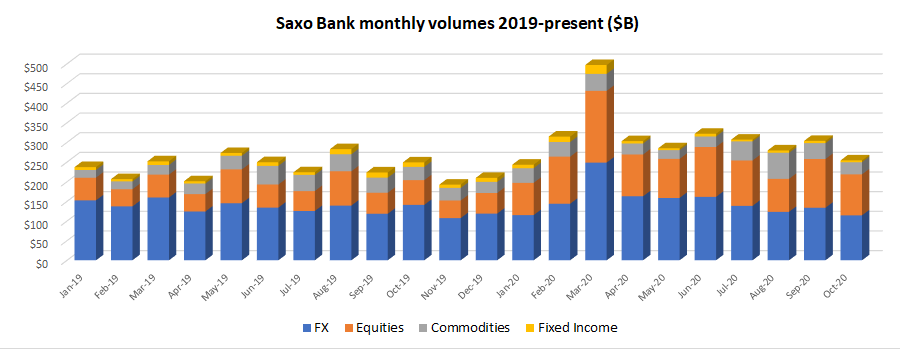

Saxo Bank FX volumes hit second lowest level in years in October 2020

Well now we understand better why the company is selling assets to focus on “core operations.”

On a day when we earlier reported that it is selling a large amount of non-core mortgage portfolio assets at its BinckBank unit, Copenhagen based Retail FX broker Saxo Bank has released one of its worst set of monthly trading volume figures in years.

All assets classes offered by Saxo for trading – FX, Commodities, Fixed Income, and Equities – saw a double digit percent drop in trading volume during October. And that in a month where industry-wide institutional FX volumes were fairly flat, while some Retail brokers reported a rise in trading.

Saxo Bank’s flagship trading product, Forex pairs, saw $114.3 billion of client trading volume in October, down 14.4% from September’s $133.6 billion and the lowest such result for Saxo since 2015, save for last November’s $107.4 billion.

Equities trading totaled $104.5 billion in October, down 16% from September. Commodities $30.8 billion, down 24%. Fixed income $4.7 billion, off 18%.

Saxo Bank is controlled by China’s Geely Group, which bought a majority interest in the company in 2018.