Saxo Bank FX trading volumes hit multi-year low in March 2024

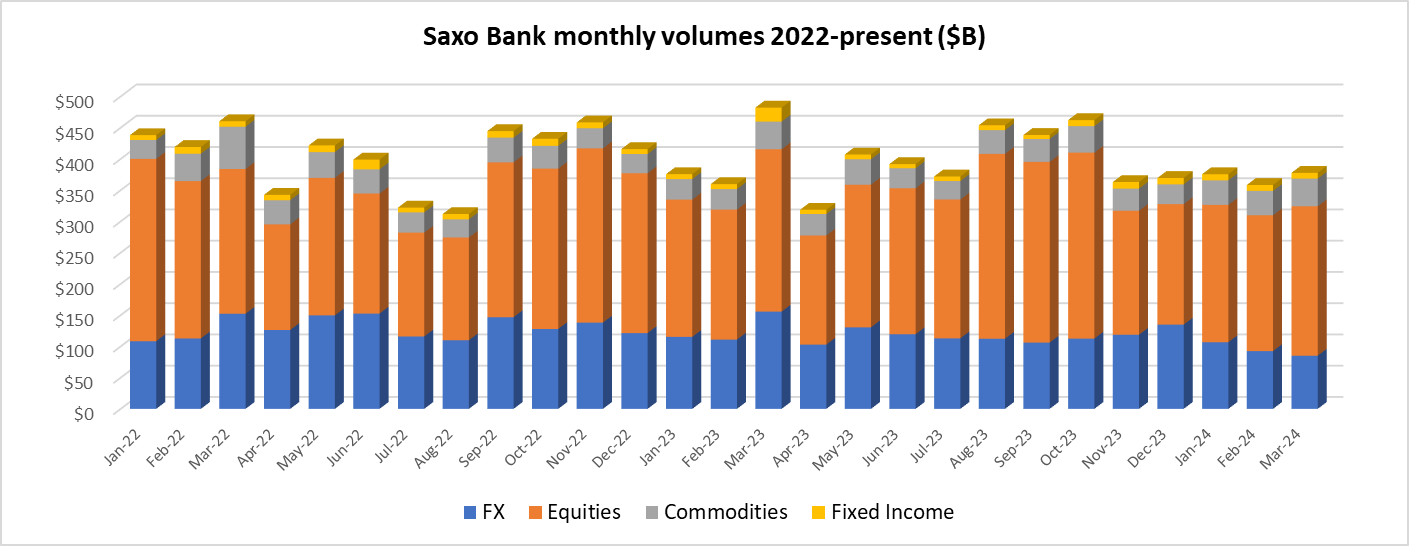

Copenhagen based Retail FX and CFDs broker Saxo Bank has released its monthly client trading activity statistics for March 2024, indicating yet another steep drop-off in the company’s core FX trading volumes, covered by an increase in Equities trading.

After seeing FX trading volumes fall to below $100 billion last month – for the first time since 2021 – Saxo Bank FX trading declined by another 8% in March, coming in at $85.1 billion, the lowest level it has been at since the company started publishing volume stats back in 2016.

On the flipside, Saxo Bank did experience a 10% MoM increase in Equities trading, and overall trading volumes came in at $377.7 billion for the month – up by 5% over February’s $358.3 billion.

For the first quarter of 2024 Saxo Bank client volumes have averaged $370.5 billion monthly, down by 7% from 2023’s overall average of $399.4 billion.

Client trading volumes at Saxo Bank in March 2024 were as follows:

- FX trading down 8% MoM to $85.1 billion.

- Equities up 10% to $239.2 billion.

- Commodities up 13% to $44.1 billion.

- Fixed income trading down 2% to $9.3 billion.

Saxo Bank is controlled by China’s Geely Group.