Saxo Bank enables Singapore clients to schedule recurring deposits with eDDA/eGIRO scheduler

Multi-asset investment specialist Saxo Bank makes investing regularly easier, with eDDA/eGIRO scheduler.

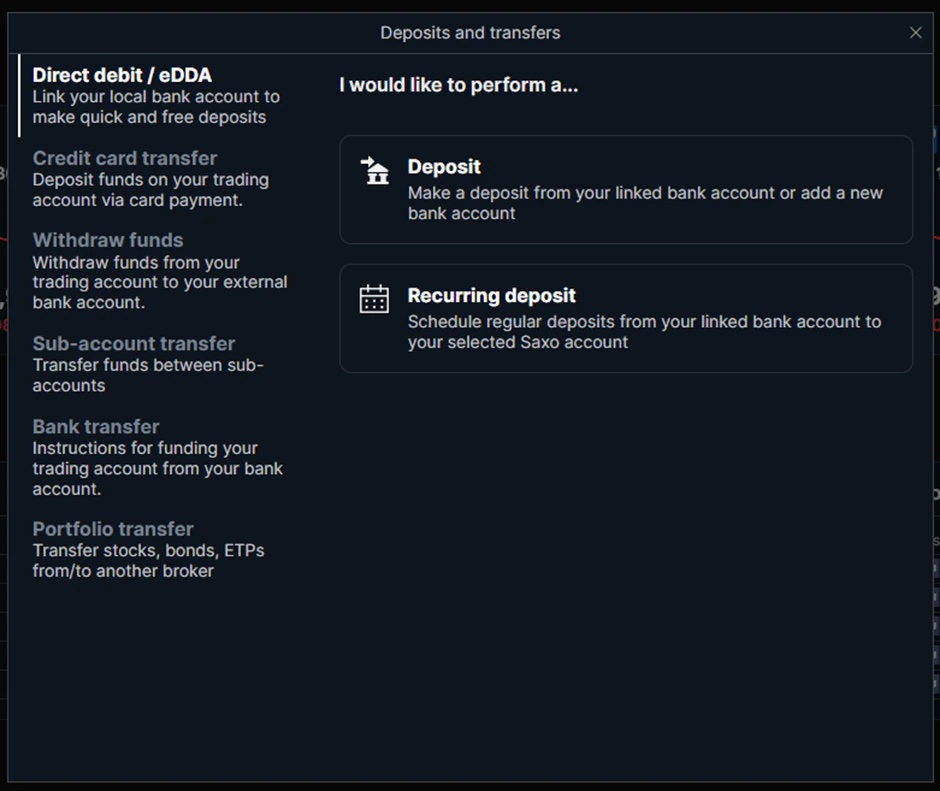

Clients of the Singaporean arm of Saxo can now schedule recurring deposits in their Saxo account via eDDA/eGIRO scheduler.

Saxo’s new eDDA/eGIRO scheduler now lets you transfer funds automatically from your bank account to your Saxo account on a regular basis, such as weekly or monthly.

eDDA stands for electronic Direct Debit Authorisation, also referred to as eGIRO. A convenient and free payment service. With eDDA, you can transfer funds from your bank account into your Saxo account, from within your Saxo account, without logging into online banking.

Saxo uses eGIRO to support the eDDA feature available in Saxo’s platform. eGIRO is a joint initiative by The Association of Banks in Singapore (ABS) and participating banks, supported by the Monetary Authority of Singapore (MAS).

By scheduling your deposits from the Saxo platforms, you can invest regularly more easily than before. This is particularly helpful for SaxoWealthCare, SaxoSelect and Regular Savings Plans, which grow your portfolio over time.

Let’s recall that Saxo launched SaxoWealthCare in Singapore in April 2022. The service represents a wealth manager that helps people achieve their life goals, by reducing time stress, knowledge gap, and increasing adaptability and flexibility over time.